XRP Falls 12% in a Week as Network Activity Declines

XRP is under high sales pressure, down more than 5% in the last 24 hours and more than 12% in the last seven days. The recent slowdown was accompanied by increasingly lower technical indicators, including a strong increase in the trend force and a collapse of chain activity.

With the weakening of pricing and the drop in user engagement, concerns are on XRP’s ability to have key support levels. Unless the feeling moves quickly, the path of the slightest resistance seems to be downward.

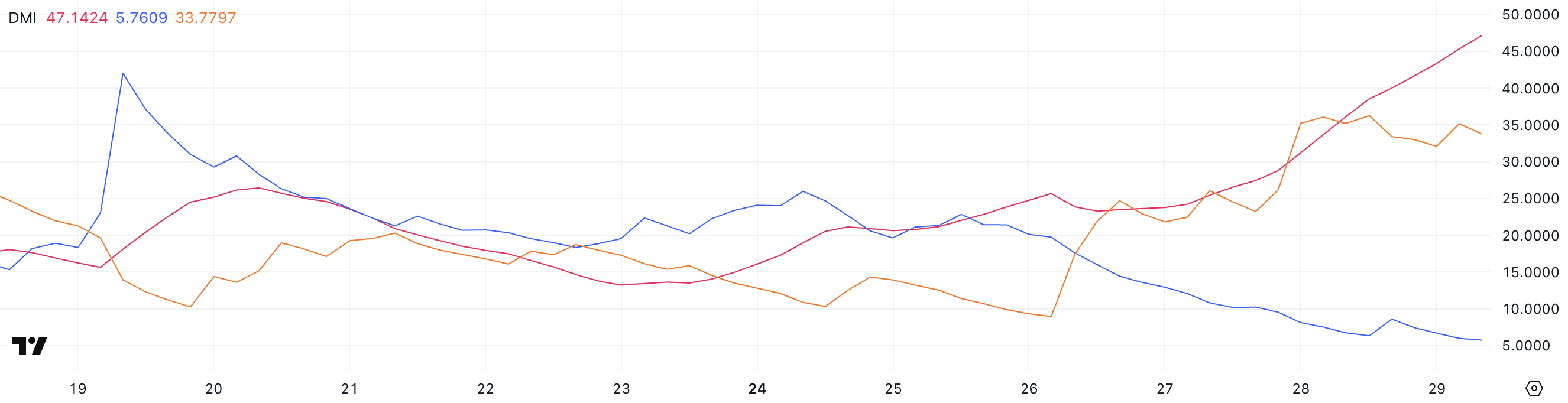

The DMI graph shows that the current downward trend is very strong

The XRP directional movement index (DMI) is currently flashed with high lowering signals, the average directional index (ADX) going to 47.14 from 25.43 just a day ago.

The ADX measures the strength of a trend, whatever its direction, and the values above 25 generally indicate that a trend is gaining momentum.

A reading greater than 40 – as the current level of XRP – suggests that a very strong trend is at stake. Since XRP is currently in a downward trend, this increasing ADX indicates the intensification of the downward dynamics and a market strongly leaning towards new declines.

By digging deeper into the DMI components, the + DI, which follows the price pressure upwards, fell sharply from 20.13 to 5.76. Meanwhile, the -Di, which follows the downward price pressure, went from 8.97 to 33.77.

This striking divergence strengthens the downward trend, indicating that sellers aggressively take control while the force of buyers fades.

With ADX confirming the strength of this movement and the directional indicators tilting strongly, the price of XRP could remain under short -term pressure unless a significant reversal of feeling occurs.

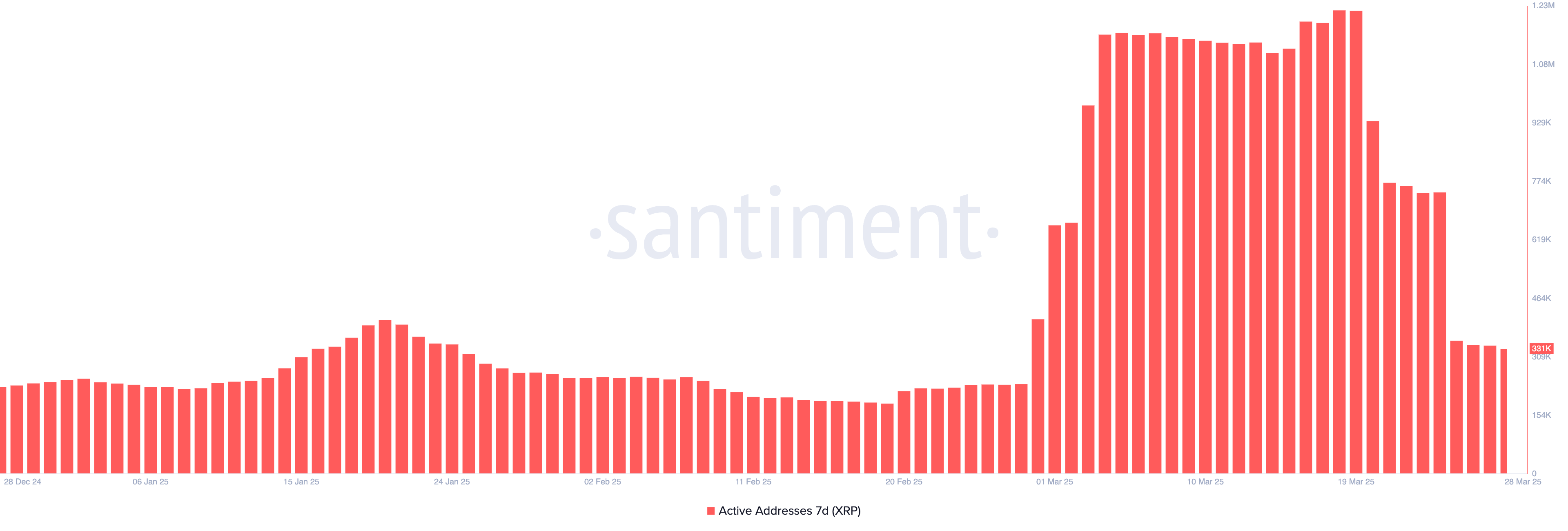

XRP active addresses are strongly decreasing

Active addresses of 7 days of XRP experienced a sharp decline in last week, following a recent wave of new heights of all time. On March 19, metrics culminated at 1.22 million, signaling a strong activity of the network and the commitment of users.

However, since then, it has dropped to only 331,000 – a drop of more than 70%. This sudden fall suggests that the interest in transforming on the XRP has cooled considerably in a short time.

Monitoring of active addresses is a key way to assess the activity on the chain and overall health of the network. An increasing number of active addresses generally reflects the growing participation of users, the increase in demand and the potential interests of investors – factors that can support price strength.

Conversely, a sharp drop like that of the XRP is currently underline to weaken the momentum and the discoloration of interest, which could exert additional pressure on the price.

Unless user activity begins to bounce back, this drop in network engagement can continue to weigh on the short -term prospects of XRP.

XRP could fall below $ 2 soon

The exponential Mobile Mobile Lines of XRP (EMA) are currently reporting a strong downward trend, with short -term EMAs positioned below those in the longer term – a conventional lower alignment.

This configuration indicates that the recent amount of price is lower than the average in the longer term, often observed during sustained corrections. If this downward trend continues, XRP could reset the level of support at $ 1.90.

A break below which could open the door to a deeper drop to $ 1.77 in April.

However, if changes in market feelings and the XRP price manage to reverse the course, the first key level to watch is the resistance at $ 2.22.

A successful escape above this point could trigger a renewed bullish momentum, which potentially led the price up to $ 2.47.

If this level is also violated, XRP could push further to test the $ 2.59 brand.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.