XRP Futures Trading Goes Live on CME, Fueling ETF Hopes

XRP’s term contracts are now live on the CME, marking a new era for the liquidity of the assets. This significant tradfi approval cachet can increase the chances of ETF XRP to obtain a green light.

ETF analysts generally believe that an XRP ETF is now guaranteed that this trading has been put online. XRP’s own price has not reacted much to this development, but the news has been well telegraphied and may have been assessed.

Institutional exhibition essential for XRP?

After several months of anticipation, the CME group finally offers XRP and micro XRP term contracts. The CME announced for the first time that it would list these offers at the end of April, and they were put online on time.

According to the CEO of Ripple Brad Garlinghouse, the first trades took place on Hidden Road, a brokerage platform that Ripple recently bought:

“The launch of XRP regulated term contracts on the CME marks a key institutional step for XRP … and very excited to announce that Hidden Road released the first block of blocks on the CME at the opening!” Garlinghouse claimed via social media.

Since these markets have just opened, no commercial data on XRP’s term contracts is still accessible to the public. Even so, the opening came with a lot of brass band, and XRP lovers have several things to hope for.

The advent of CME future trading brings some key advantages to XRP. On the one hand, it has long been assumed that it massively increases the chances of success of the XRP ETF.

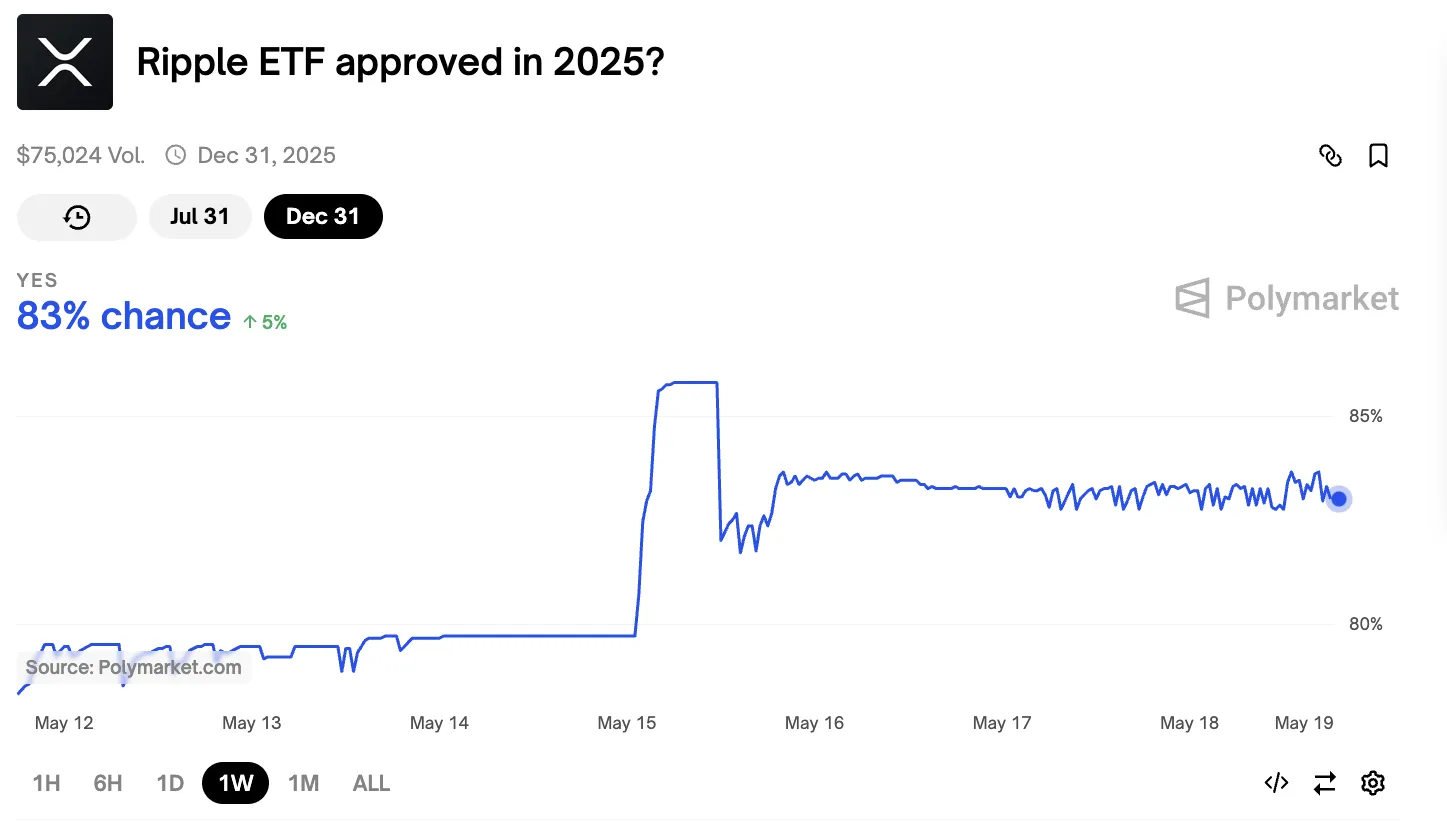

According to Nate Geraci, FNB popular analyst, the approval of the dry is now “only a matter of time”. The chances of success remain more than 80% on the polymarket, but today’s developments have not increased them.

Despite this, many things are still uncertain of the future of XRP. Since a judge has rejected a settlement in the dry trial v Ripple last week, there is an increasing debate within the community.

Is XRP a security or a commodity? Although it is generally treated as a commodity, a reclassification could seriously put on the ETF procedure.

For the moment, the future XRPs are live on the CME, and this is an important step. To be fair, the price of XRP has not yet increased much, but this date has been announced well in advance.

In any event, this evolution focuses on long -term growth, the introduction of new liquidity and institutional exposure and throwing more foundations for possible recognition of the FNB.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.