XRP Price at Risk of Dropping Below $2 Amid Bearish Signals

XRP is under pressure, down almost 7% in last week. However, its 24 -hour negotiation volume jumped almost 52%, reaching $ 2.3 billion, indicating high activity around Altcoin.

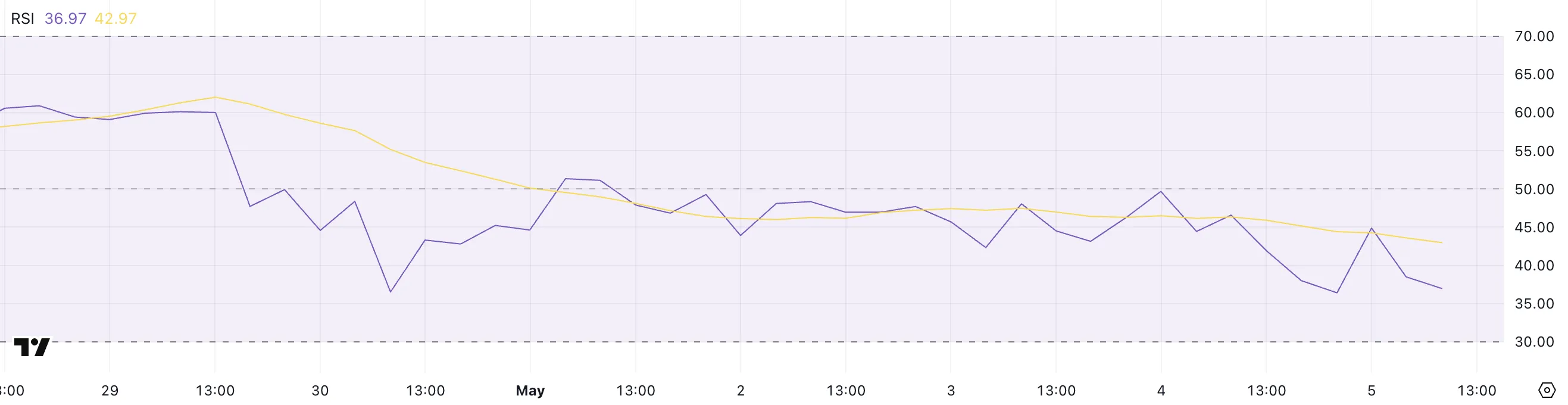

Several technical indicators indicate a downward perspective, including a weakened RSI, a configuration of fully down ichimoku clouds and an imminent death cross in EMA lines. With the fragile and keys to feeling levels, the next XRP movement will probably depend on the fact that buyers intervene or that Momentum continues to erode.

XRP RSI falls to 36.97: is a reversal to come?

The relative force index of XRP (RSI) fell sharply to 36.97, against 49.68 one day ago. This decrease suggests a clear loss of momentum, the indicator now approaching the surveillance territory.

The RSI is a widely used momentum indicator which varies from 0 to 100. It helps traders to identify potential reversal areas.

Readings above 70 generally indicate that an asset is on cover and can face a decline, while readings less than 30 suggest that it can be occurred and started for a rebound.

With RSI from XRP now at 36.97, it approaches the occurrence threshold but has not yet reached it. This level indicates to weaken the purchase pressure and could mean more short -term drop if the sale continues.

However, if the RSI falls below 30 and stabilizes, it can trigger purchasing interests to traders anticipating a rebound.

For the moment, XRP is in a warning zone – neither strongly occurring nor neutral – suggesting that this price action in the coming days will be crucial to determine its short -term direction.

Ichimoku signals the downward trend for XRP with clear resistance to clouds

The Ichimoku cloud painting for XRP reveals a decisive coastal structure in all key components. The price is positioned below Tenkan-Sen (blue line) and Kijun-Sen (red line), indicating that short-term and medium-term momentum is aligned with the decline.

This configuration generally suggests a current sale pressure without clear reversal sign in the immediate term. In addition, the Span Chikou (green offset line) is below the current price and the cloud, strengthening a strong lower feeling from a momentum.

This alignment of the elements indicates that XRP remains under pressure downwards, buyers unable to regain control of the trend.

The Kumo (cloud), representing future support and resistance, has become red and is projected downwards – another lowering signal. The price being well below the cloud confirms that XRP is in an entirely downward phase in the analysis of Ichimoku.

In addition, the gap between the Senkou Span A and B lines (the edges of the cloud) widens slightly, which suggests that the bearish momentum can still be strengthened rather than discoloration. To move the perspectives, XRP must first break above the Kijun-Sen and ultimately push in the cloud, neutralize the bearish momentum.

Until then, the technical perspectives remain weak and the traders can remain cautious unless a bullish inversion scheme manifests.

XRP perspectives: measurement of looms, resistance levels in the home

The exponential mobile averages of XRP (EMAS) show signs of weakness, with potential death formation on the horizon.

A death cross occurs when a short -term EMA crosses a long -term EMA, signaling a possible change in a sustained decline. If this lowered crossroads confirms, the XRP price could go down to test the support level at $ 2.11.

Failure to comply with this level can accelerate the drop, opening the door to new losses to $ 2.03.

However, if XRP manages to regain strength and reverse the quantity of movement of the current, it could target resistance at $ 2.18.

An escape above this level would be a short-term bullish signal and could push the price to $ 2.24.

The continuation of the purchase pressure beyond this could prepare the land for a passage to $ 2.30 and possibly $ 2.36, especially if the broader feeling of the market improves.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.