XRP Price Climbs Higher, But Here’s Why the Rally Could Be A Trap

The Ripple XRP is up 4% in the last seven days, surfing a wave of improving feeling on the wider Altcoin market.

However, despite this ascending impulse, key indicators on the chain suggest that the rally may soon lose steam while XRP holders rush to lock the profits.

XRP is up 4% this week, but merchants are quietly out of the market

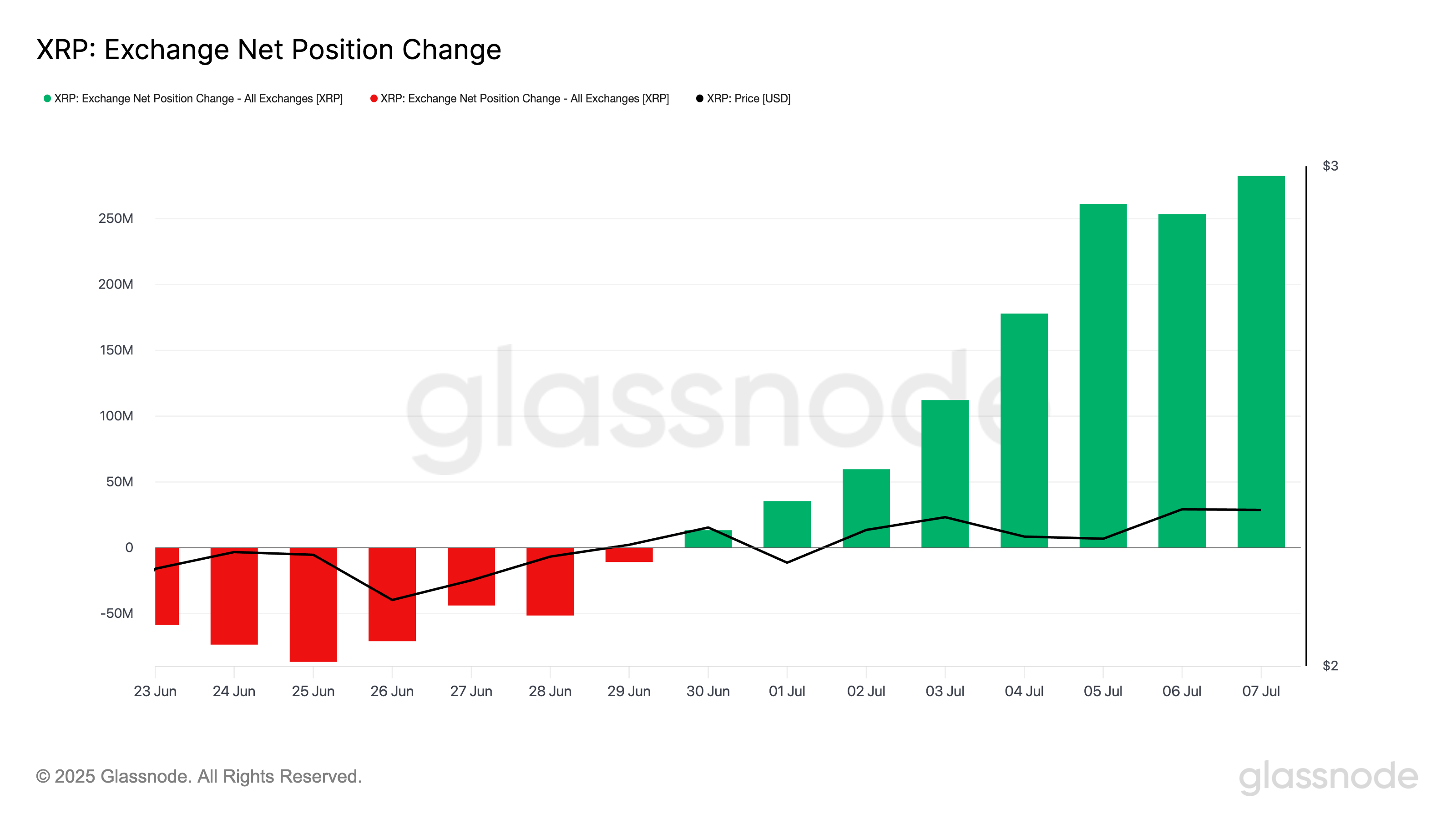

Glassnod data reveal a regular increase in the change in net exchange of XRP during last week. The data on the chain show that this metric, which follows the net quantity of tokens going to centralized exchanges, reached a summit of eight months of 283 million XRP on July 7.

The timing is notable because the tip of exchange entries coincides with the recent increase in XRP prices. This means that many traders seem to use the rally as an opportunity to leave the positions, exercising a certain downward pressure on the token.

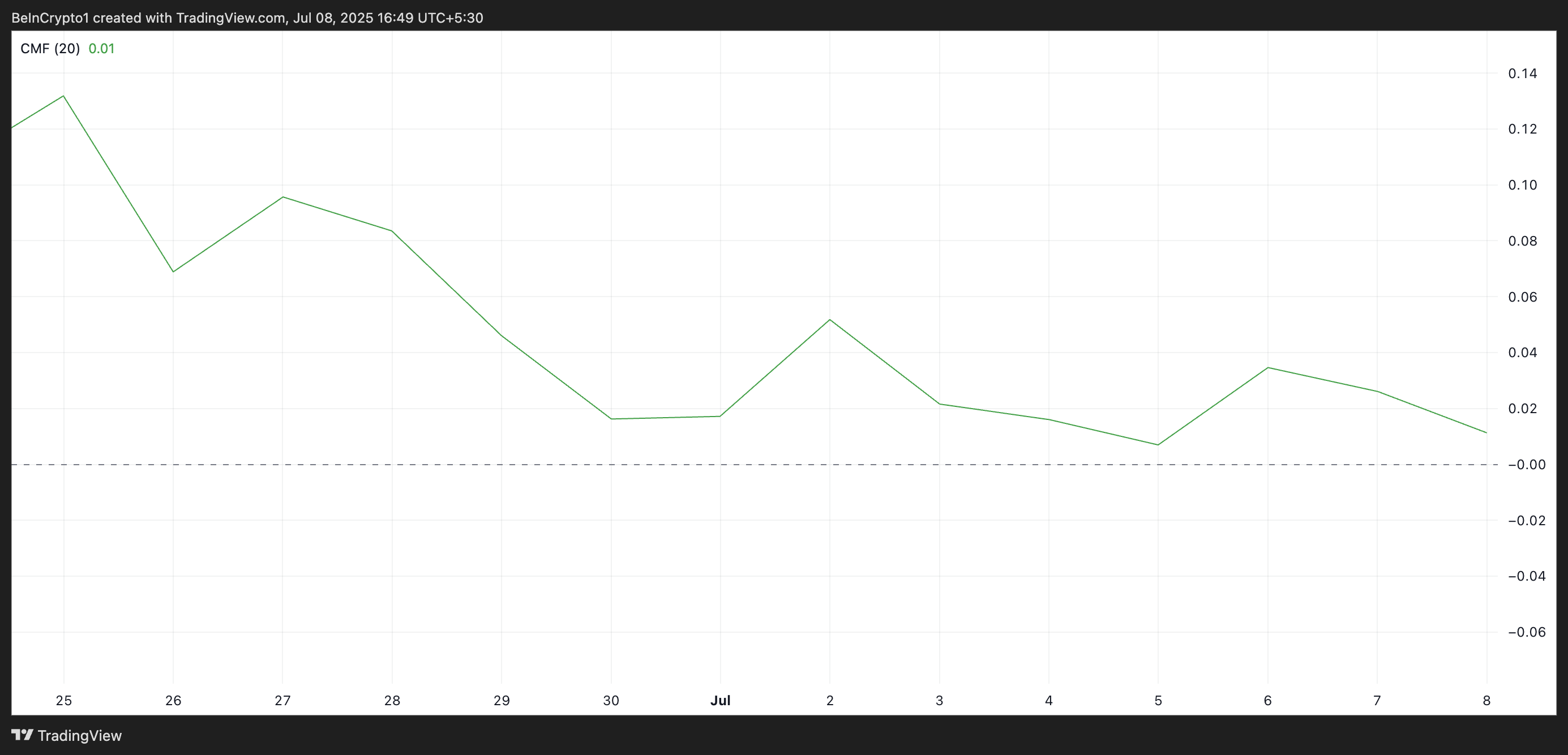

In addition, despite the tip of XRP, its monetary flow of Chaikin (CMF) gradually tended to decrease, forming a negative divergence with the price of the token. When writing these lines, this indicator is 0.01, about to break below the zero line.

The CMF indicator measures how silver flows in and outside an asset. When its value is positive, it suggests a high demand and an upward amount of price. On the other hand, the negative readings of CMF indicate the strengthening of the sales pressure and the growing lower feeling.

While the XRP CMF has not yet fallen below the zero line, its continuous decrease in signals weaken accumulation. This trend often precedes a downward reversal and, in the case of XRP, this result seems likely unless the cool demand between the market to absorb the growing supply.

The loss of this support could a decrease at $ 2.14

On the daily graphic, XRP retains the lower line of the ascending canal that it tends in last week.

This channel is formed when the price of an asset systematically makes higher highs and higher stockings in the two lines of trends parallel. The upper line acts as a dynamic resistance, while the lower line serves as a dynamic support.

Therefore, when the price begins to test the lower border, especially after a strong rally, it often signals exhaustion in the momentum upwards.

A decisive break below this lower support line is considered to be a lower signal, as it suggests that buyers can no longer keep the trend. If this happens, XRP risks fell at $ 2.14.

However, if the Bulls regain control and demand for demand, they could lead the price of XRP to $ 2.35.

The post XRP price rises above, but that is why the rally could be a trap appeared first on Beincrypto.