XRP Price Rally Faces Critical Test Amid Growing Sell-Off Pressure

XRP was one of the remarkable interpreters on the cryptography market in the last month. Its price has climbed 72% in the middle of a wider Altcoin rally fed by Bitcoin walking towards new peaks of all time.

However, two critical indicators on the chain now suggest that this upward trend may lose steam, which increases the risk of a short -term reversal.

XRP Traders accumulates for decline as signals on red flash chain

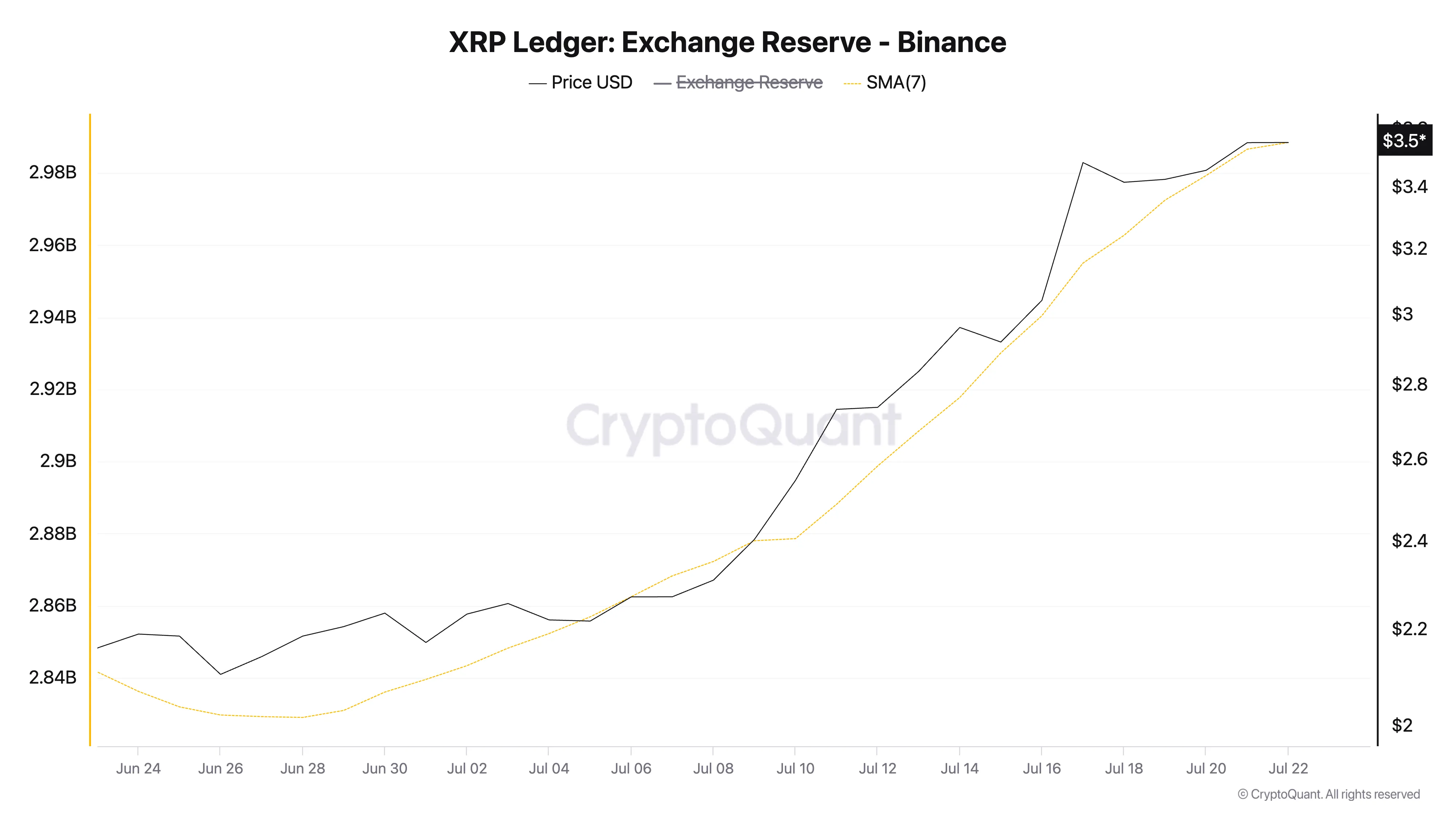

First, the XRP exchange reserve on the first exchange binance has increased sharply, reaching its highest level of the year. According to an cryptocurrency, the XRP exchange reserve – was measured using a seven -day mobile average – ranked a higher of the year at 2.98 million tokens on July 22, worth more than $ 10 million at current market prices.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

A peak in the reserve of exchange of an asset indicates that more tokens are moved to centralized exchanges, often in preparation for the sale. When investors transfer large quantities of a room to exchanges, they can position to take profits or output positions.

In the case of XRP, the thrust of a 2.98 million token reserve implies an increased intention to sell. If this influx of supply does not meet the equal or higher demand of buyers, the downward pressure on the price of XRP could quickly build.

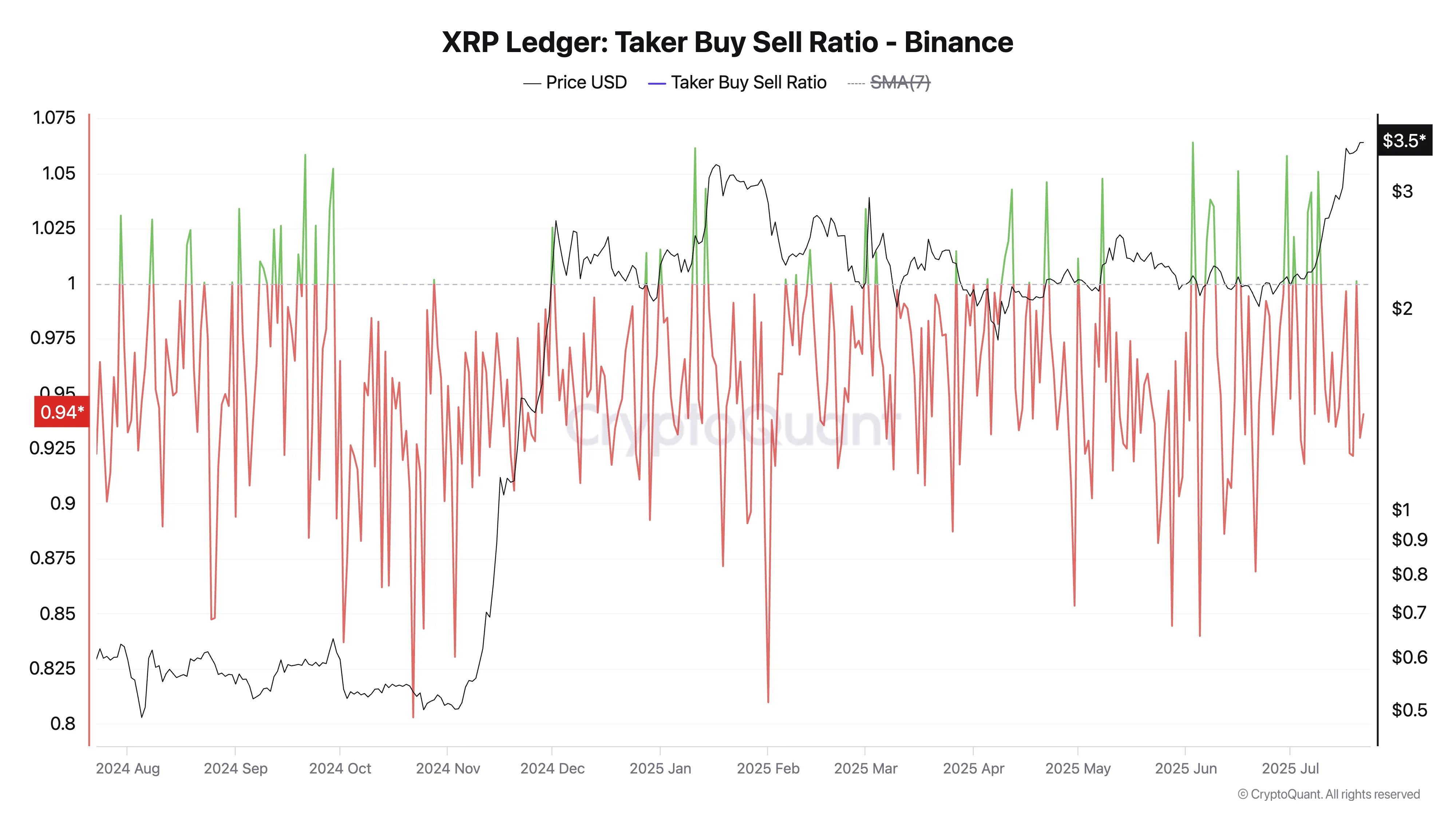

In addition, cryptocurrency data shows that the XRP buying / sale ratio has always remained below one since July 10. When writing these lines, the metric is 0.94

The Buy-Sell ratio of an asset measures the ratio between the purchase and sales volumes on its long-term market. The values greater than an indication of more than sale volume of purchase, while the values lower than a suggest that more traders in the long term sell their assets.

The fluctuation of the purchase / sale of XRP takers less than one in the last two weeks indicates a sales trend among long -term merchants as a price ascent. This sales sale pressure confirms the weakening of feeling and could trigger a drop in prices in the next sessions if it continues.

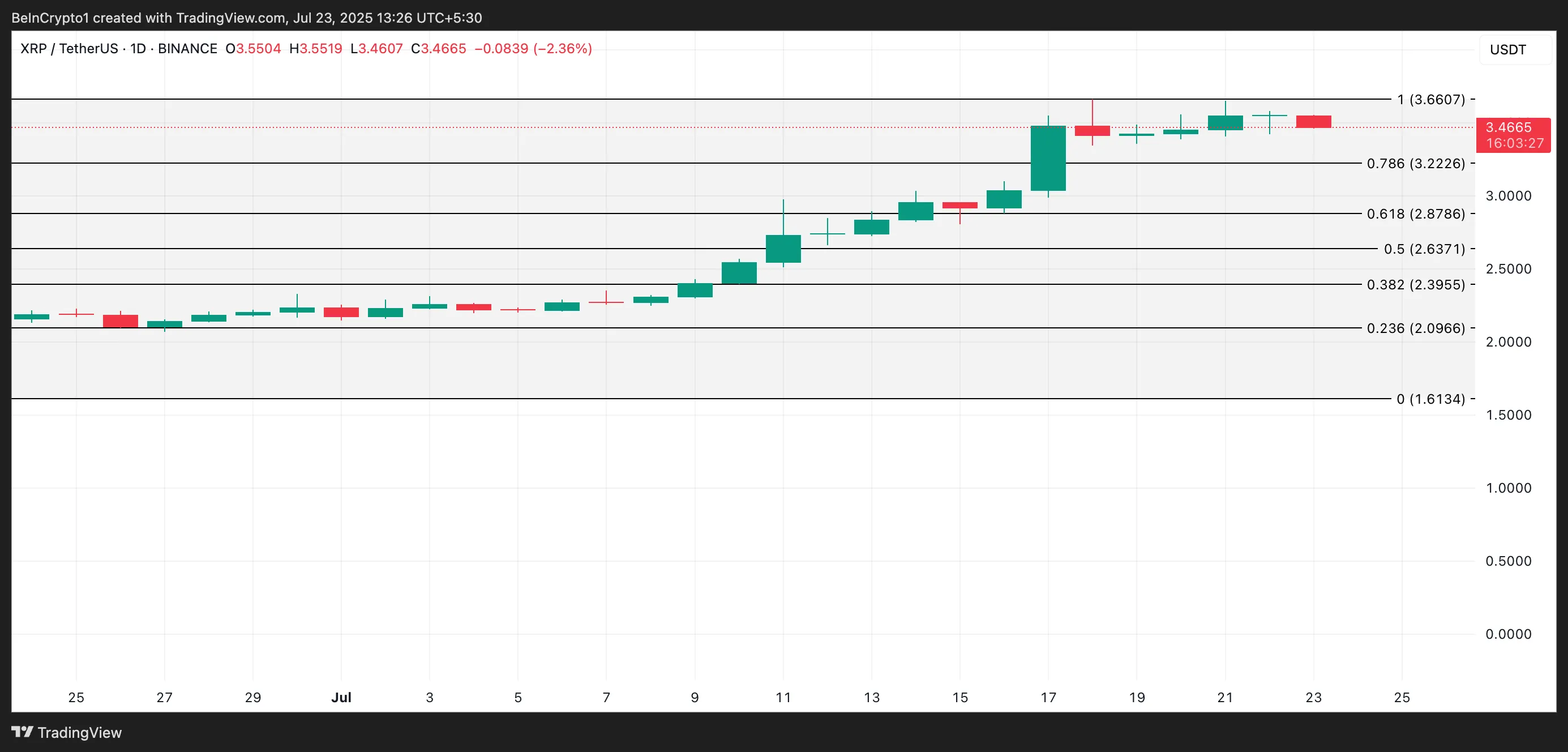

XRP Bulls key test at $ 3.22

At the time of the press, XRP is traded at $ 3.47, just below its $ 3.66 summit. However, the assembly of the sale pressure increases the probability of a short -term correction to the level of support of $ 3.22.

If this floor yields, XRP could extend its decline to around $ 2.87.

However, if the sales pressure accumulates and the cool demand enters the market, Altcoin can recover its prices peak and potentially acquire new gains beyond $ 3.66.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.