XRP Price Rally Unshaken by $70 Million Whale Move

XRP has climbed 3% in the last 24 hours, driven by a bullish feeling renewed on the cryptography market and a large -scale whale transaction.

On July 19, Blockchain Tracker Whale Alert reported a significant transfer of 20.5 million XRP – more than $ 70 million at the time – an unknown portfolio in Coinbase.

UND -term contracts have reached a record of $ 11 billion as institutional bets grow in the midst of an increased increase

This transaction has sparked speculation that the whale could prepare to make profits after the recent token rally.

Historically, transfers to centralized exchanges are often interpreted as precursors at the pressure of the sale, especially during the market feedback.

However, this decision has not yet affected the ascending momentum of XRP.

According to Beincryptto data, the token briefly affected a summit of $ 3.54, extending a one -week rally which saw it win 25%. This wave reports XRP near its summit of $ 3.84 in 2018.

The rally reflects a broader recovery in the cryptography sector, with total market capitalization recently crossing the milestone of 4 billions of dollars.

The feeling of investors seems to improve as American regulatory conditions thus facilitate more interest in the sector.

Meanwhile, XRP is also gaining momentum on derived platforms and not only on the cash market.

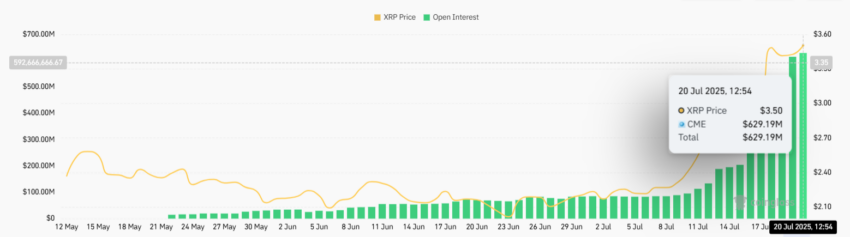

According to Correglass data, the interest open in the perpetual XRP contracts exceeded $ 11 billion, representing around 3.1 billion tokens of leverage.

This marks a new summit and eclipses the peak of 8 billion dollars previous seen at the end of January before the second presidential term of Donald Trump.

As a general rule, an increase in open interests as well as price growth often signals institutional participation and confidence in the long -term perspectives of the assets.

Bitget leads the term market, holding more than 20% of the open positions worth 2.2 billion dollars. In particular, CME assets also reflect an increase in institutional interests, reaching a record summit of $ 630 million.

Meanwhile, this growth aligns XRP with other high -level digital assets such as Bitcoin and Ethereum. These assets have aroused strong institutional interest in the space of derivatives in the past year.

XRP’s renewed force occurs in the heels of Ripple’s legal resolution with the American Commission for Securities and Exchange (SEC) and Key upgrades to the Grand Book XRP.

These developments have helped to position digital assets for sustained relevance in an evolving market.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.