XRP Price Set For $2? Chart Signals Bearish Move

In the middle of the uncertainty of the current market, the XRP price failed to maintain its recent escape over the downward trend line and a crucial horizontal level of $ 2.40. The drop in the price below this key level has once again changed the feeling of the market, and it seems to form a lower price action model.

XRP technical analysis and key levels

According to Coinpedia’s technical analysis, XRP remains in an upward trend because it continues to be negotiated over the exponential mobile average (EMA) on the daily time. However, falling below the key level of $ 2.40 has now paved the way for a potential $ 2 in the coming days.

For the moment, $ 2 is a crucial level of makeup or rupture which could determine if the price recovers its losses or is undergoing an additional drop.

XRP price prediction

Currently, XRP seems to form a head and lower shoulder pattern. The level of $ 2 acts as a neckline, which could serve as a level of makeup or rupture.

The potential neckline at $ 2 is a key level where the 200 EMA also seems to provide support for XRP. However, if the feeling of the market remains unchanged and the price falls below this level, a net sale could occur, pushing XRP from 37% to $ 1.20 in the future.

However, this lower price prediction is only valid if the price of XRP falls below $ 2 level; Otherwise, the asset has high potential to use all of their losses. This drop in prices and the negative feeling probably comes from current tariff wars.

Current price momen

At the time of the press, XRP is negotiated nearly $ 2,32, having dropped by 2.50% in the last 24 hours. However, during the same period, its negotiation volume jumped 10%, indicating increased participation of traders and investors compared to previous days.

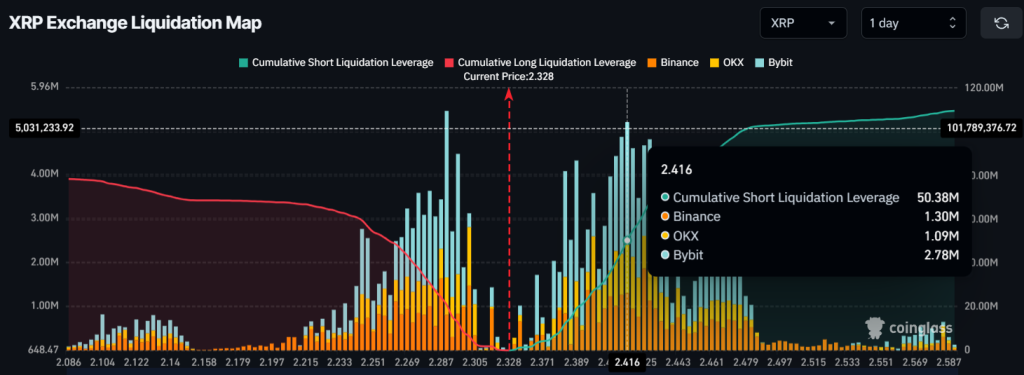

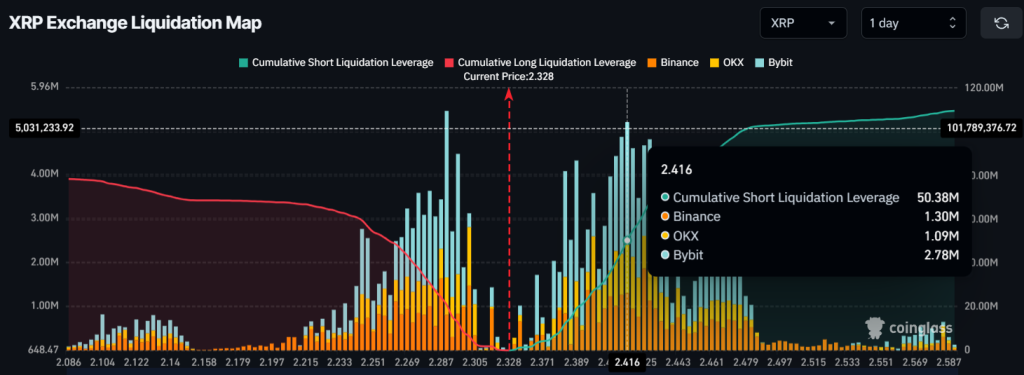

Key liquidation levels

The drop in prices lower than $ 2.40 has transformed the feeling of traffic, because they seem to be strongly bet on the short side, according to the Coiginglass chain analysis company.

The data reveal that the traders are over-placed at $ 2.29 on the lower side and $ 2,416 on the upper side, having built $ 20.85 million in long positions and $ 51 million in short positions in the last 24 hours.

The accumulation of short leveraging positions signals an increased lowering feeling. If this imbalance continues, XRP could face increased sales pressure.