XRP Price Struggles Amid 53% Drop in Active Wallets

The price of XRP has dropped by almost 4% in the last 24 hours and is down 21% in the last 30 days, which brings market capitalization to $ 144 billion. The decline occurs while the flash key indicators of warning signs, the monetary flow of Chaikin (CMF) reaching its lowest level since June 2022 and active addresses lowering 53% in the last month.

In addition, XRP EMA lines form a death cross, signaling the potential for the additional decline if the trend continues. With a weakening of the momentum, XRP now faces a critical moment, while traders look if the price stabilizes or risks a deeper correction.

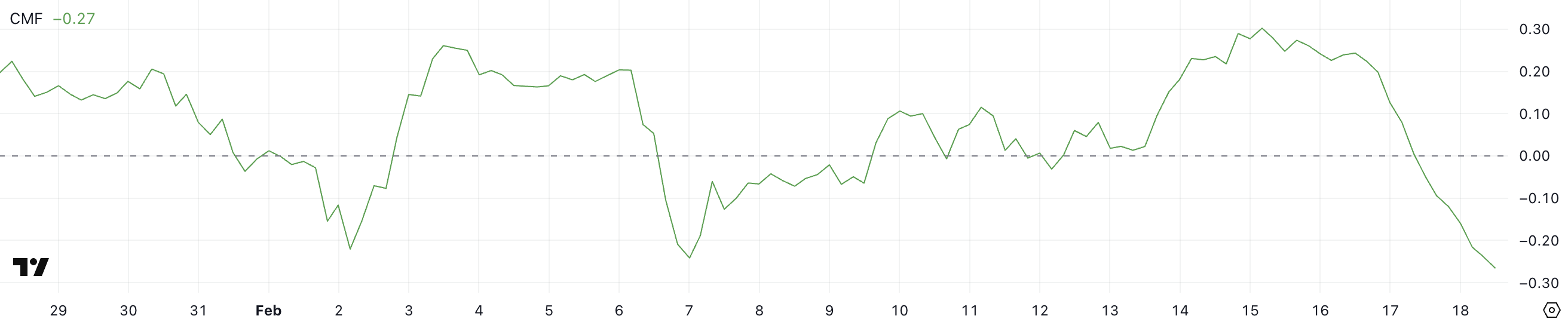

XRP CMF beats negative records

The monetary flow of XRP Chaikin (CMF) fell to -0.27, pursuing a constant drop of 0.30 three days ago.

The CMF indicator measures the pressure of purchase and sale by analyzing both the price and the volume. The values higher than zero indicate an accumulation and lower than the distribution of the zero signal.

A sustained drop in CMF suggests that the sales pressure increases, with more capital which moves from XRP than from it. This downward trend reflects a weakening of the bullish momentum and could indicate that investors unload their positions.

This is the lowest XRP CMF reading since June 2022, a signal concerning price action. Historically, prolonged negative CMF levels have preceded prolonged downward trends because they indicate persistent capital outputs.

If the indicator remains in negative or continuous territory to decrease, XRP could cope with additional sales pressure, increasing the risk of deeper price loss.

However, if CMF begins to recover and gets closer to zero, it could suggest stabilization, giving the bulls a chance to regain control. For the moment, XRP remains in a vulnerable position, traders looking closely if the sales pressure will intensify or remember in the coming days.

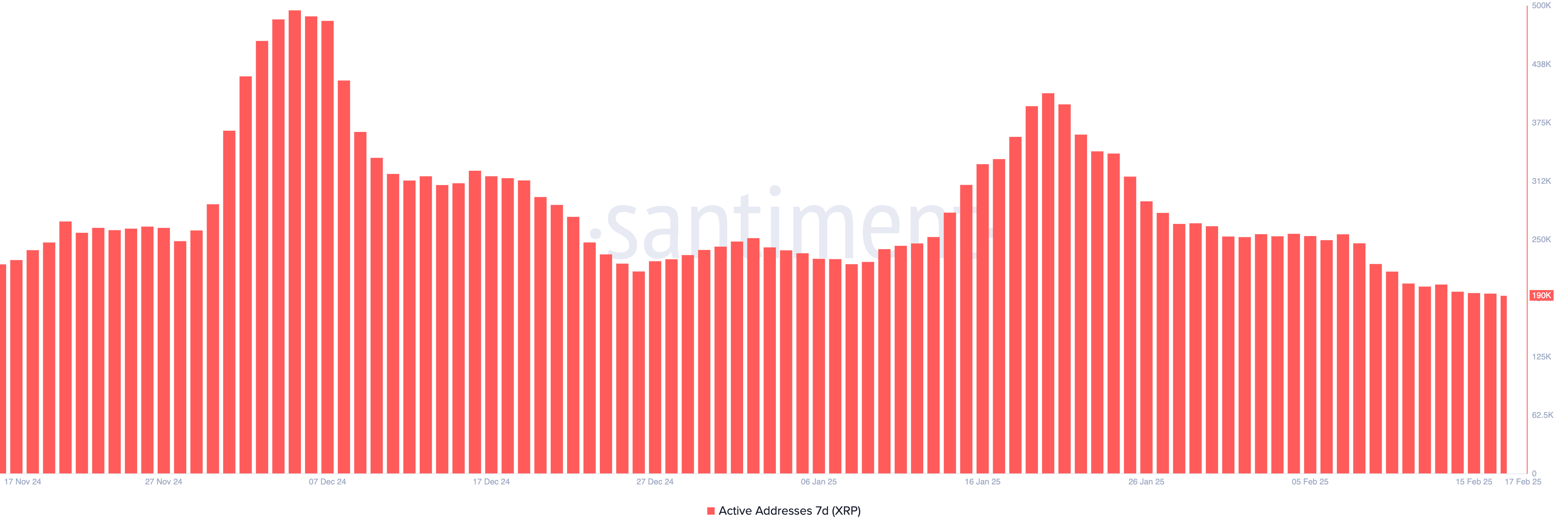

Active XRP addresses corrected 53% last month

The active addresses of 7 days XRP fell to 190,470, marking a sharp decline of 53% compared to the 407,000 recorded on January 20. This metric follows the number of unique addresses involved in transactions over a period of seven days, serving as a key indicator of the network activity and global commitment of users.

A drop in this magnitude suggests a reduction in the participation of merchants and investors, potentially signaling decreasing interests or the drop in demand for transactions.

Such a drop can often coincide with lower price action, as fewer active addresses generally mean lower liquidity and less activities on the chain stimulating market movements.

This is the lowest number of the lowest active XRP since November 14, 2024, strengthening concerns about the drop in user engagement. Historically, prolonged declines in this metric preceded periods of decreasing prices or pressure, because the reduction in network activity often reflects the peeling momentum.

If the active addresses continue to decrease, this could indicate to weaken the confidence of investors, which makes XRP more difficult to support significant bull movements.

However, if this metric stabilizes or begins to bounce back, it could suggest a renewed interest in the assets, potentially supporting price recovery efforts. For the moment, XRP remains in a prudent phase, the supervisor supervisor if the activity will resume or continue to decrease.

Price prediction XRP: Will XRP be faced with an additional 29%correction?

The EMA of XRP lines form a cross of death, with short -term mobile averages crossing those below in the long term, signaling a potential downward trend.

A confirmed death cross often suggests that the drop in the momentum is strengthening, increasing the probability by further Decreases XRP prices.

If the sale intensifies, the XRP price could test the support at $ 2.33, and a ventilation below this level could trigger a correction of 29% to $ 1.77. Such a decision would strengthen the lowering feeling and could lead to prolonged weakness unless buyers intervene to defend the key levels.

However, if XRP can reverse this trend and resume the bullish momentum, it could question the level of resistance of $ 2.83.

A successful escape above this area could open the way to a rally at $ 3.15. If Momentum persists, XRP could push up to $ 3.28, marking its first movement above $ 3 in February 2025.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.