XRP Whales Decline As Price Remains Consistently Below $3

The XRP price has evolved over the last seven days, reflecting market indecision. Although it is still down almost 15% in the last 30 days, its relative resistance index (RSI) is currently neutral to 55.1, showing a balanced momentum after having recovered almost viscous levels.

Meanwhile, XRP whale addresses have decreased recently, suggesting caution among the big holders. However, the figures remain historically high, indicating continuous interest. XRP could either challenge resistance to $ 2.83 or test critical support at $ 2.52 if the sales pressure is intensifying.

XRP RSI is currently neutral, restoring itself after almost touching levels of occurrence

The relative resistance index of XRP (RSI) is currently at 55.1, against a recent peak of 62 two days ago, but up compared to 33.2 barely three days ago.

This shows that the purchase has increased in the past few days, pushing XRP RSI above after having almost reached the territory of occurrence. However, the decrease of 62 suggests that the purchase pressure is slightly cool, with XRP now in a neutral area.

This level indicates a balanced momentum, leaving the short -term uncertain price management.

RSI is a momentum oscillator which varies from 0 to 100, measuring the speed and variation in price movements. As a general rule, an RSI above 70 is considered to be overcrowd, signaling a potential decline, while a RSI less than 30 is considered to be, suggesting a possible purchase possibility.

With RSI from XRP to 55.1, it is above the neutral brand 50, showing a little more purchase pressure than sales pressure. This could indicate a cautious optimistic feeling, with the potential for XRP to continue its movement up if the purchase of interest remains strong.

Conversely, if the RSI begins to decrease below 50, it could point out a weakening momentum and a possible withdrawal of prices.

XRP whales are still high, but down

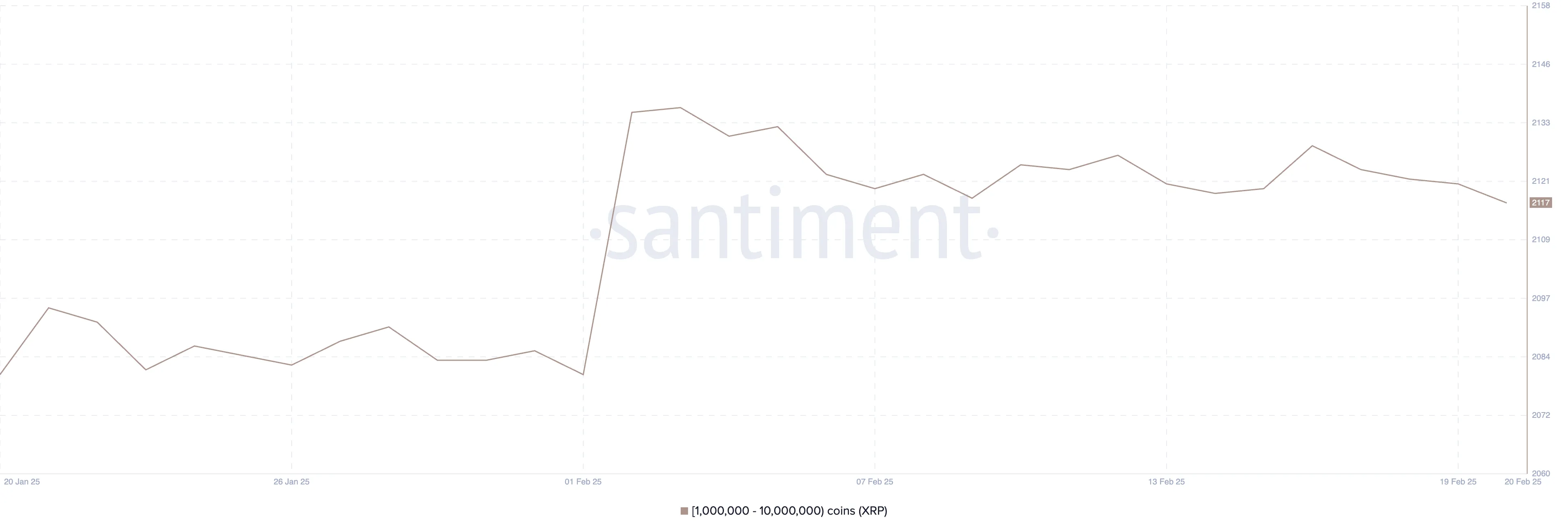

The XRP whale addresses, holding between 1 million and 10 million XRP, culminated at 2,137 on February 3, but since then decreased to 2,117.

This regular decline suggests that some major holders reduce their positions, which could indicate caution or profit. Despite this drop, the number of whales remains higher than historic averages, which shows a continuous interest of large investors.

The monitoring of whale addresses is important because they can considerably influence price movements. A drop in the number of whales may indicate the sale pressure, which can weigh on the XRP price.

However, as the current number of whales is still historically high, it suggests that substantial capital remains invested, potentially supporting the price if the purchase of interest resumes.

XRP The next trend direction is not yet clear

The price of XRP has evolved laterally during last week, with its exponent lines on a mobile average (EMA) compared closely.

This indicates a lack of clear momentum, suggesting market indecision and low volatility. This shows that the purchase and sale of pressure is balanced, which does not know if an upward trend or a downward trend will follow.

If an upward trend is developing, XRP could first test resistance at $ 2.83, and the rupture above could cause targets to $ 3.15, or even $ 3.28, its highest levels Since the end of January.

Conversely, if a downward trend emerges, support for $ 2.52 is crucial. A break below this level could lead to a drop to $ 2.33, and if the sales pressure continues, it could drop as low as $ 1.77.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.