Yellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

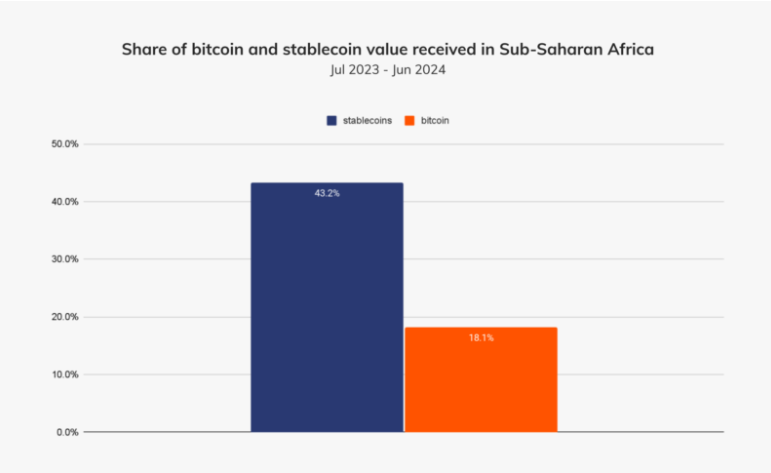

For years, crypto in Africa was synonymous with Bitcoin (BTC). Today, this story turned, with companies like Yellow Card, an exchange of crypto operating in Africa, clearly reflecting this change.

In an exclusivity with Beincrypto, the co-founder and CEO of Yellow Card Chris Maurice reveals how he builds a network of Pan-African Stablecoin to jump traditional finance (tradfi). This is done in the midst of increasing regulatory clarity, the collapse of Fiat systems and a revolution in funding.

The Stablecoins transform the financial scene of Africa

The Pan -African exchange operates on more than 20 markets, and Mauritius says that stablecoins now represent more than 99% of its transactions. This makes yellow card a bell tower for what could be the most transforming trend in the finance of emerging markets.

“When we launched the yellow card for the first time in 2019, people exclusively bought Bitcoin. Now the most popular asset is Tether (USDT),” Maurice told Beincryptto.

In this case, need, not speculation, has led this evolution. Africa directs the world of the volume of trading crypto between peers (P2P). However, unlike Global Crypto Hubs to continue volatile returns, Africans choose the staboins of financial survival.

Local currencies are expanding under inflationary pressure in countries like Nigeria, which ranks second in the world in adoption of cryptography (by chain-analysis). The Stablecoins offer a reliable reserve of value and transparent means of cross -border payments.

This is particularly essential in a continent with sending annual funds of $ 48 billion and persistent banking limitations.

“Stablecoins solve the practical challenges of financial services in Africa. People are not in love with technology. They need faster and cheaper means to move money to survive and prosper,” added Maurice.

Infrastructure built for

The yellow card went beyond Trading services. Its infrastructure incorporates mobile monetary systems (such as M-Pesa in Kenya) and local fiduciary currencies such as Nigerian Naira and Ghanaian Cedi. According to the CEO of the company, this Help users on board without bank accounts.

By managing compliance, currency exchange and internal payments, the company allows companies to operate without combating unreliable local rails.

“Our mission is to allow companies to invest, hire and develop in emerging markets without the need to underline on infrastructure. We built the back office [meaning] cybersecurity, AML, [and] Data protection, so that they can focus on growth, “he said.

The regulatory dam has broken

Mauritius also observed that African regulators kept crypto in limbo for years. In view of Yellow Card, 2024 marked a tilting point.

“There is a regulatory impulse in Africa which only accelerates. The dam has broken,” he said.

South Africa now classifies crypto as a financial product. He dismissed major exchanges like Luno and Valr. The countries of the Central African Economic and Monetary Community (CEMAC), Maurice, Botswana and Namibia have followed suit with license diets.

Meanwhile, regulatory incubators emerge in Kenya, Nigeria, Rwanda and Tanzania. In this context, Maurice said Yellow Card actively helped write legislation in Kenya and support cryptographic frameworks in Morocco.

Fight the informal market

However, challenges remain. In countries like Ethiopia, Cameroon and Morocco, prohibitions have passed underground users in high -risk P2P networks. The yellow card pushes for frames which level the rules of the game for compliant players.

“We are faced with many competitors on the part of companies that do not maintain high LMA standards … A fair playground is all we are looking for,” he said.

With 85 million dollars in venture capital funding, the yellow card deploys capital in compliance and in partnerships. With this, the company is positioned as the essential infrastructure provider for global companies that seek to exploit African markets.

From Africa to emerging markets everywhere

Cross-border payments may be the most powerful case of Yellow Card. The company’s co-founder claims that its rails supplied with the stable reserve helps companies reduce working fund needs, developing in new regions and hiring more quickly.

“We have had customers who told us that we allowed them to develop in new countries and considerably reduce their costs. This is a real economic impact, ”said Maurice.

The company does not stop in Africa. Its infrastructure extends over other border markets, with a wave of strategic partnerships expected in 2025.

“Yellow Card has built a series of easy buttons for the world developed companies to develop in complicated and strong growth markets,” he noted.

The end of Swift?

Perhaps the most daring claim of Yellow Card is what she sees on the horizon of five years: the decline of rapid and traditional international transfers.

“While we look at five years, Swift is in trouble. In ten, no one will make international sons again,” said Maurice.

Supported by the security and regulatory rigor of business quality, Yellow Card attracts the interests of first -rate companies such as Paypal and Coinbase Exchange, who are looking for Stablecoin partners on emerging markets.

“Stablecoins are already part of the financial infrastructure in Africa. CFOS and treasurers in the traditional industries now use them to store and transfer the value,” he added.

The African cryptography market is still small compared to global giants. Nevertheless, while the world goes from speculation to utility, fragmented financial systems of the continent can offer an overview of the most impactful use of crypto: economic empowerment. For the yellow card, the mission is clear and more and more urgent.

“We have built a business for longevity and scale. The adoption of cryptography in Africa is the adoption of stablescoin, ”concluded Maurice.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.