ZKJ, KOGE Flash Crash Triggers Binance Alpha’s Sharp Downturn

Once a centerpiece of the market, Binance Alpha is now witnessing a sharp drop in users and commercial volume.

Here’s how the ZKJ and Koge Flash crash has considerably hampered the interesting growth of this platform.

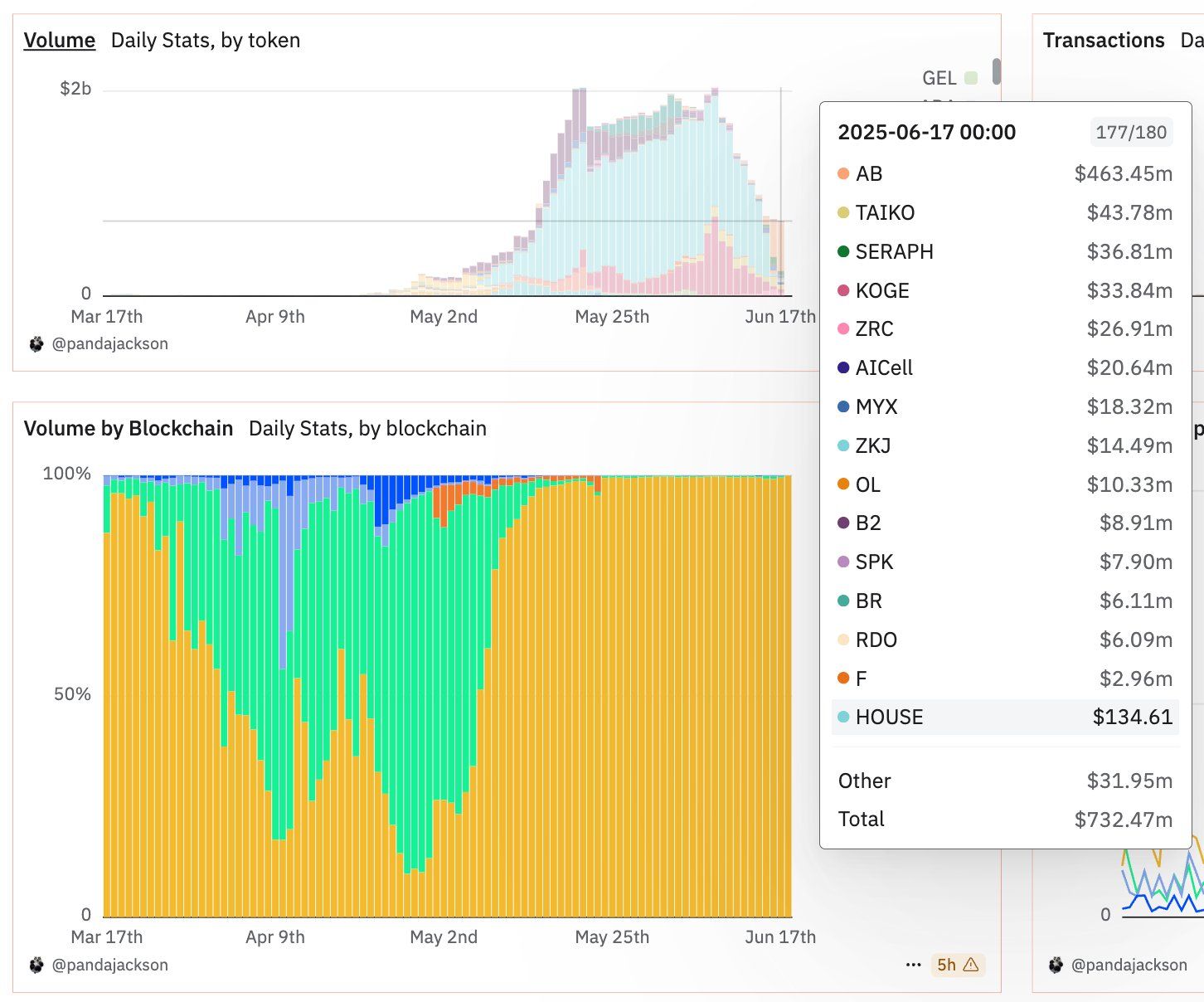

Binance Alpha sees a drop in trading volume

Dune data reveals that Binance Alpha Active users increased from 233,000 on June 12 to 195,000 before June 15, equivalent to a loss of almost 40,000 users in just three days. In particular, active trading users have decreased to around 55,000, reporting an almost unstoppable drop in morale and confidence.

The deep cause comes from the unexpected flash crash of two key toys, ZKJ and Koge. The primary trigger lies in whale wallets, which have massively removed liquidity, triggering a widespread sales effect, the structure of the pool incapable of resisting accumulated discharge controls.

After this collapse, the commercial volume of Binance Alpha, previously culminating at 2.04 billion dollars on June 8, plunged from 63% to around $ 749 million a few days later.

Immediately after the drop in the price of pointed token, Binance announced a new policy aimed at limiting the tactics of “false volume” which provide no real market value. However, the community judged this response “too late”.

Some users have urged Binance to reimburse lost points or rewards, stressing that the lack of transparency during policy adjustments caused financial and important confidence damage.

What should Alpha then do?

Recent events have exposed major defects in the Alpha system: its model -based model promotes short -term feeling, leading to a concentrated volume in easily manipulated tokens.

Ab token now represents more than 63% of the trading volume on Binance Alpha per day. Previously, ZKJ and Koge also held the higher position. When large wallets withdrew, the system immediately collapsed.

“There is no particularly good target. Even if wear is low, there is always a risk of price fluctuations,” said an analyst on X.

To rebuild and recover, the binance may need to establish a transparent point allocation mechanism to discourage artificial volume, reduce dependence on centralized tokens and prioritize projects with strong liquidity and distribution.

It must also implement anti-BOT technology to control abnormal negotiation activities and improve the transparency of policies adjustment, ensuring that the community is informed early and has the possibility of providing comments to maintain confidence.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.