ZORA Price Rises, But Bearish Indicators Hint at a Trap for Late Buyers

Zora’s price has increased by 4% in the last 24 hours, driven by a slight rebound on the wider market of cryptocurrencies.

Despite today’s lift of prices, technical readings and on the chain indicate that this distribution phase remains firmly in play, the feeling of the market always dominating the market.

Zora’s bullish steam fills

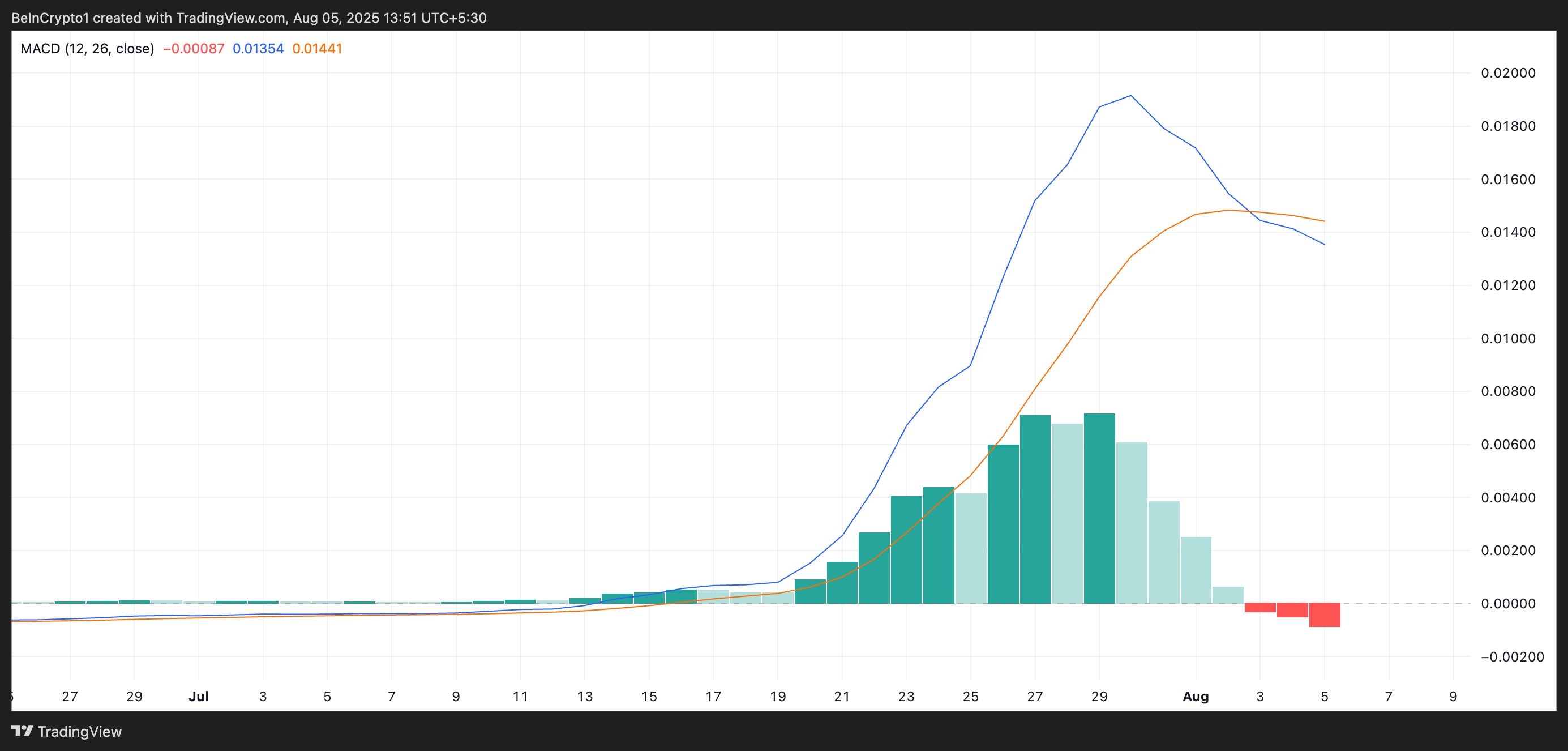

Zora / USD daily graphic readings reveal a recent negative crossing in the Zora MacD (MacD) divergence indicator. This happens when the MacD (blue) line breaks under the signal line (orange), a conventional lowering signal suggesting a decreasing momentum.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The MacD indicator of an asset identifies trends and momentum in its price movement. It helps merchants to identify potential purchase or sale signals via crosses between the MACD and the signal lines.

When the MacD line is above the signal line, it indicates an upward momentum, which suggests that the price of the asset can continue to increase.

On the other hand, when the MacD line is under the signal line and falls towards the zero brand – as is currently the case with Zora – it signals the discoloration of the bullish impulse and a potential change towards the bearish control.

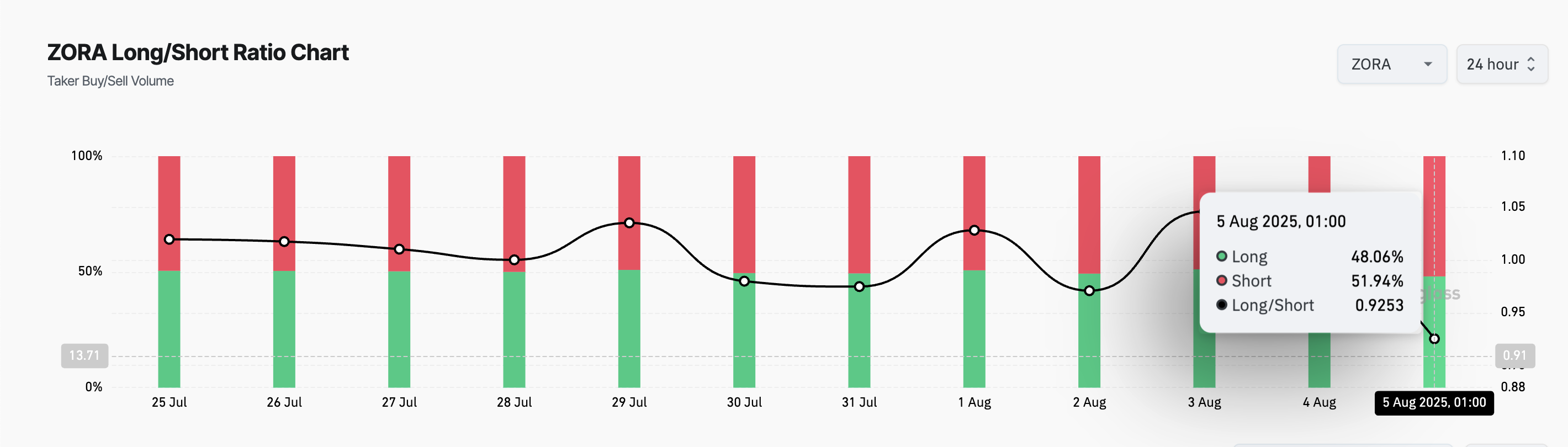

In addition, the feeling among Zora’s assets is no different. This is reflected by its long / short ratio, which is a lower 14 days of 0.92.

The long metric / short measures the proportion of Paris long to those short on the long -term market of an asset. A report greater than a longer position than short positions. This indicates a bullish feeling because most traders expect the value of the asset to increase.

On the other hand, a long / short ratio less than 1 means that more traders bet on the price of the assets to decrease than those who expect it to increase.

Consequently, Zora’s current long / short ratio suggests that most traders are preparing more and more for correction rather than a push towards new peaks.

Zora storts resistance – the merchants are preparing for a pointed movement

At the time of the press, Zora is negotiated at $ 0.0,06799, resting just below the resistance formed at $ 0.06802. If the Bears strengthen their control and the purchase of falls, the token could attend a traction to the support soil at $ 0.05666.

However, if the accumulation increases and Zora lacks $ 0.6802, it could extend its earnings to $ 0.08,431.

The post-zora price increases, but the lowering indicators refer to a trap for late buyers appeared first on Beincrypto.