Bitcoin Hits $116,000 – Here’s Why This Bull Run Is Different

Bitcoin reached a summit of $ 116,000 on July 10, only six days after Donald Trump signed the major bill. The flagship cryptocurrency has won 6% since the bill, Ethereum and other altcoins after closely.

The rally is involved in the middle of a wave of macroeconomic changes, the increase in American debt, the tightening of the bond markets and historic FNB entries.

Tax overvoltage triggers theft to hard assets

The large bill of 3.3 billions of Trump dollars, signed on July 4, sparked an immediate increase of $ 410 billion in the American debt. The invoice lifts the debt ceiling of 5 billions of dollars and permanently extends the main tax reductions.

The markets see this as an inflationist. Investors are running out of bonds and in rare assets such as Bitcoin. The size and speed of implementation of the bill have amplified fears about tax discipline.

Bitcoin, with its fixed supply, again emerges as a coverage against the discharge of Fiat.

Blackrock’s Spot Bitcoin Etf (Ibit) has reached $ 76 billion in assets under management. It was triple what he held only 200 days of trading ago.

In comparison, it took the largest gold ETF over 15 years to reach the same milestone. Institutional flows are now a powerful engine of price action, pushing Bitcoin deeper into the general public portfolios.

The withdrawal of the feeding balance tightens liquidity

In June, the federal reserve reduced its $ 13 billion toll, which brought it to 6.66 dollars, the lowest since April 2020. The Fed has now reduced more than $ 2.3 billions of dollars in the last three years.

Meanwhile, the Treasury Holdings is down 1.56 billion of dollars during the same period. With fewer buyers on the bond market and more debts, investors move in other value reserves.

Bitcoin has become the best candidate.

In addition, Ethereum is negotiated near $ 3,000up 14% Since the major bill has become law. Solana, avalanche and other altcoins are also gathering.

The retail and institutional sales capital returns. The pieces even and the DEFI tokens gain ground as the yields of the speculative feeling. The crypto again leads the risk cycle.

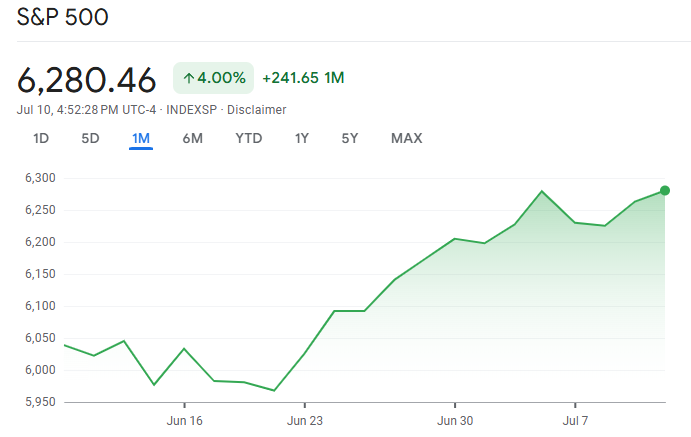

S&P 500 all high time: risk at all levels

The S&P 500 has jumped 30% since its low April 2025, reaching a new summit of all time this week. This indicates strong investor confidence in high -growth and high -risk assets.

Bitcoin benefits directly from this environment. As actions come together, crypto tends to follow. The market considers the major bill as an indirect stimulus – and it reacts accordingly.

End

The latest Bitcoin summit is a response to structural changes – not media threshing. The major bill has expanded the deficit and rocked confidence in the American debt markets.

With the fear of inflation that increases and growing institutional access, Bitcoin becomes the Macro coverage of choice. While the crypto enters a new bull market, all eyes are now turning to the Federal Reserve and decisions to lower rates.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.