Bitcoin Price Holds Steady, But One Level Blocks Rally

Bitcoin shows an unusual force this week. While the wider market of cryptography is down by more than 5% on the day of the day, the BTC price is down 0.6%, holding around $ 118,000.

This type of flat performance on a low market generally indicates an optimistic intention. But despite a clear lack of sales pressure, Bitcoin did not break out. And the rally, for the moment, is still pending. It’s time to know why!

Taker SELL Volume The collapse shows that bears are distant

One of the cleanest signs that sellers retreats is the steep drop in taker sales volume. On July 25, Taker Sell Volume reached a local peak of almost $ 17.8 billion. Since then, he has dropped almost 93%, seated at $ 1.2 billion at the time of the editorial staff.

This type of collapse of the assault on the sales side suggests that bears no longer stimulate the market.

Normally, when the sellers disappear like this and Price holds firm, it opens the way. But in the case of Bitcoin, the price has not disappeared anywhere. This does not weaken the upward thesis; It just means that the rally is interrupted, not invalidated. What is missing is a trigger.

Taker SELL Volume follows the value of the trades where sellers are the attackers: that is to say when people sell to the market in the offer. A drop in this metric shows that fewer traders try to quickly pour the parts, which generally reflects fear or reduced exhaustion on the side of the sale.

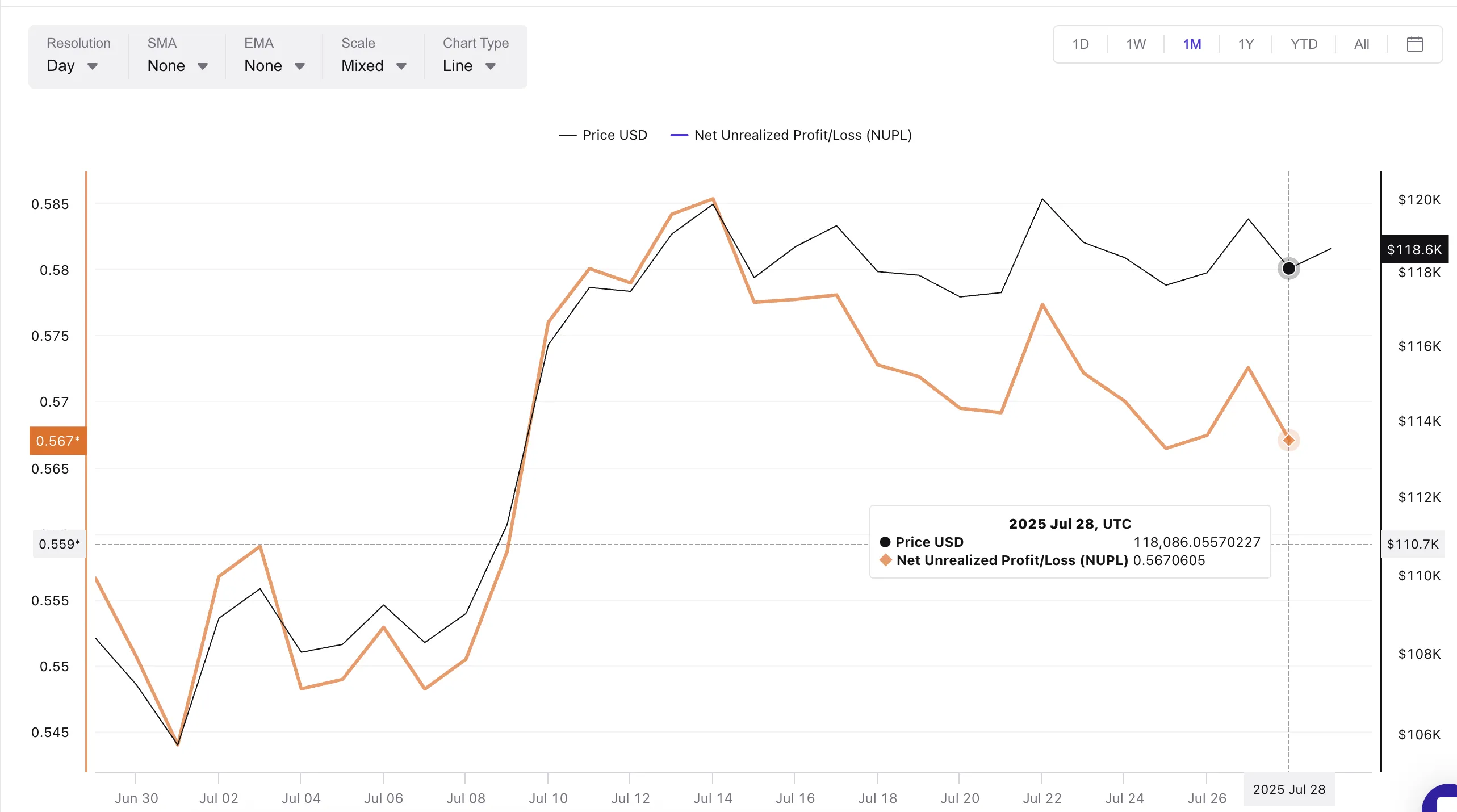

NUPL peaks continue to trigger profits

The missing trigger can be psychological and the profit / net loss not made (NUPL) helps to explain why. NUPL measures the amount of profit not made in the system, giving an approximate meaning when holders may feel tempted to sell.

In the past two weeks, Bitcoin has repeatedly tested the level of $ 119,000 to $ 120,000, occurring on July 14, July 17, July 22 and even on July 27. Each time, Nupl culminated between 0.57 and 0.58, and each time, the price of the BTC failed to break and fell.

It is not a coincidence. This is the market reporting that $ 119,000 to $ 120,000 has become a key area.

Since the last rejection, Nupl has decreased slightly while the price has been stable. This suggests that certain benefits have already taken place. The merchants have locked around $ 120,000, and the market now digests this movement without new waves of sellers.

NUPL means a net profit / loss. He compares the Bitcoin market capitalization to his ceiling made, telling us essentially how the profits are seated without selling. When NUPL is high, there is more incentive to make profits. When it drops while the price holds, it means that a certain profit has already occurred, which can reset the market for another step.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

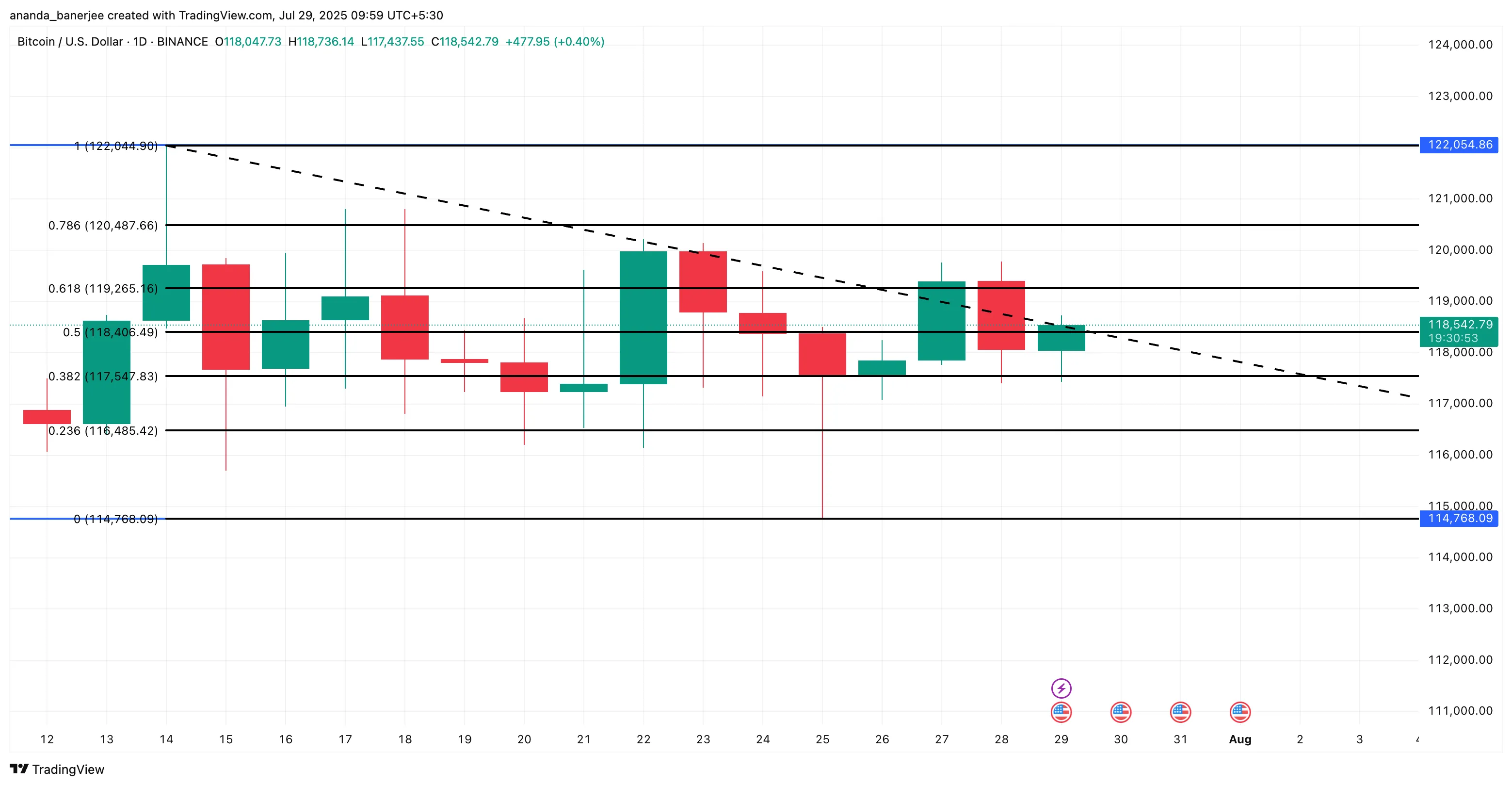

Bitcoin The price is resistant, but needs a clean break above This level …

Despite several escape attempts failed above $ 119,000, the BTC price is still higher than key support of $ 117,000 and $ 118,000. This zone is supported by the levels of trace of 0.382 and 0.5 Fibonacci, which both spent several tests.

The sellers moved away, but the buyers could not return the range.

What retains bitcoin is resistance, both technical and behavioral, at $ 120,000. This is where the FIB level of 0.786 is located, and it is also there that Nuppl culminated more recently. Until BTC erases this area with conviction, the Bitcoin rally remains blocked.

But if $ 120,000 breaks, the structure opens quickly. BTC could move around $ 122,000 and perhaps beyond. With the missing sale pressure, the benefits already taken and intact support, the conditions of the next Bitcoin rally are still alive; They just need a push.

However, the upward hypothesis fails in the short term if the price of Bitcoin drops less than $ 117,000, which then opens the doors to $ 114,000, overthrowing the entire lower structure.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.