Bitcoin Spot Outflows Surge Amid Middle East Tensions

Bitcoin faces an intensified sales pressure today, with a significant increase in outputs from the punctual market. This occurs when the markets clashed on Friday with the consequences of the Israel strike on Iran, aroused geopolitical uncertainty.

The part is down 3% in the last 24 hours, and the technical indicators indicate a momentum of decreasing buyers. If the down pressure persists, BTC could slide more, potentially testing lower support levels in the coming days.

Bitcoin faces more losses as indicators become red

In the past 24 hours, the BTC decreased by almost 5%, oscillating around the $ 105,000 mark. The increased feeling of risks stimulates capital out of the cash market, signaling the confidence of traders and institutional participants.

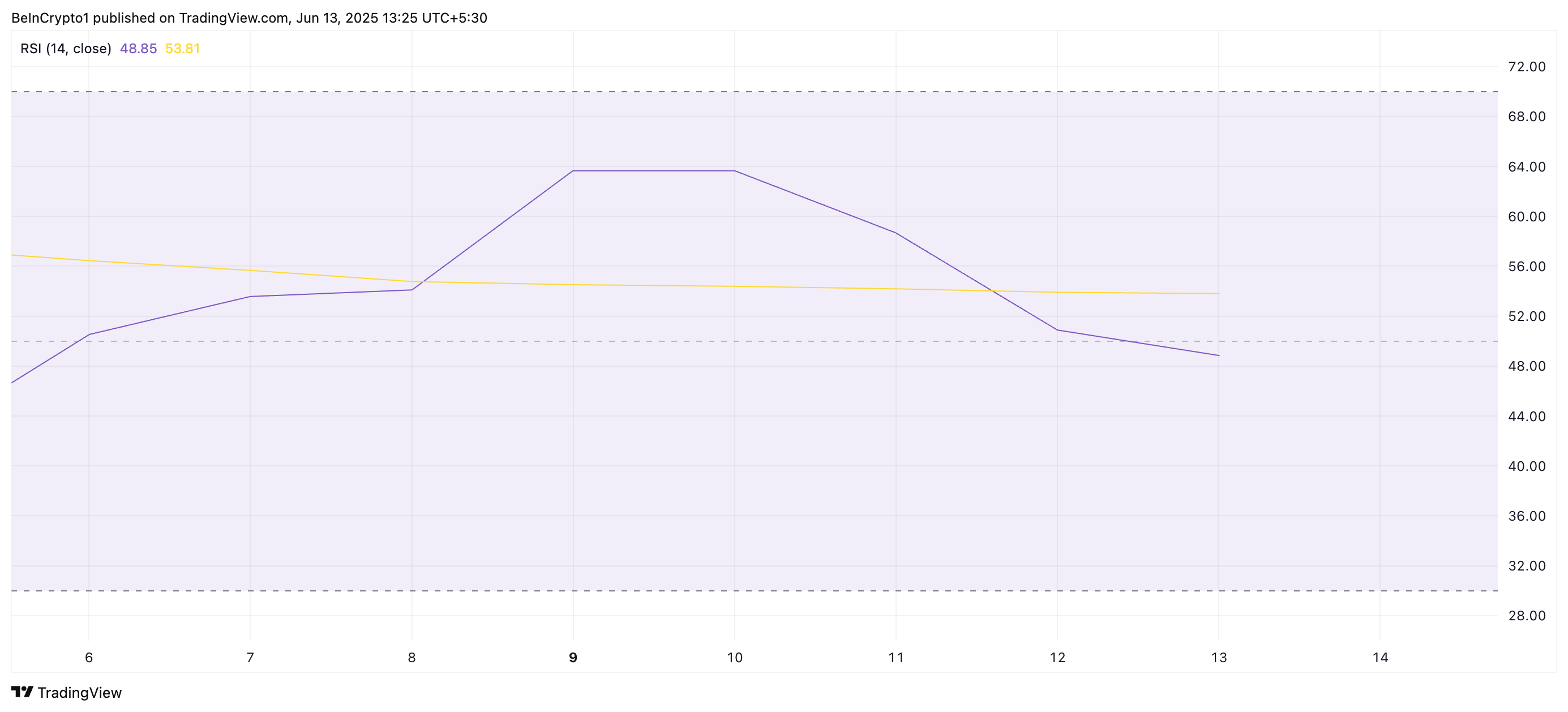

On the daily graphic, the Relative BTC (RSI) force index broke below the levels of 50 neutrals, confirming the time of purchase in rapid decrease. To date, this indicator is 48.85, faced with the decline.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100, with values above 70 suggesting that the asset is exaggerated and due for a drop in prices. Convoresly, values of less than 30 indicate that the assets are occurring and can attend a rebound.

BTC’s current RSI reading reflects the weakened bullish momentum and refers to the probability that new short -term price reductions.

In addition, the configuration of the divergence of the average convergence of the part (MacD) supports this downward perspective. To date, the MacD line of BTC (blue) rests under its signal line (orange), a trend that indicates the domination of the pressure of the sale.

The MacD indicator of an asset identifies trends and momentum in its price movement. It helps merchants to identify potential purchase or sale signals via crosses between the MACD and the signal lines. During the configuration in this way, the sale of activities dominates the market, referring to new price reductions.

BTC bears tighten adhesion as a price lag

BTC is currently negotiated at $ 105,304, marking its third consecutive red candle on the daily graphic. With the demand for coins that continue to decline, this is likely to drop to the support floor at $ 103,061. If the Bulls do not defend this level, a deeper drop to $ 101,610 could occur.

However, if a new request emerges, the BTC could get out of its downward trend and rally at the level of resistance of $ 106,548.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.