Solana Faces Resistance While ETH Sees DEX Volume Boost

Solana (soil) tries to recover from a correction of almost 12% in the last seven days. The RSI has increased in exaggerated territory, suggesting a strong bullish dynamic. However, the Bbtrend remains deeply negative, although it begins to worry, referring to potential stabilization.

Meanwhile, the EMA lines are preparing for a possible golden cross, indicating that a trend reversal could form if the keys to resistance levels are broken. However, with Ethereum exceeding Solana in volume Dex for the first time in six months and the levels of critical support not far below, soil remains in a delicate position.

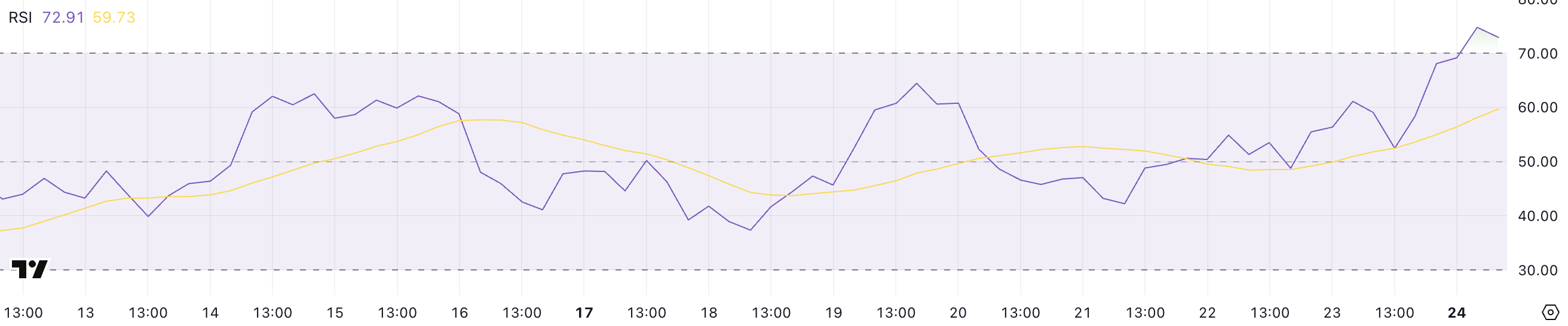

RSI Sol is now at surachat levels

The Relative force index of Solana (RSI) increased to 72.91, up 38.43 barely one day, which indicates a rapid change in the momentum of neutrally bullish territory.

The RSI is a widely used momentum oscillator which measures the speed and extent of price movements on a scale from 0 to 100.

Readings above 70 generally suggest that an asset is exaggerated and may be due to a decline, while the levels of less than 30 indicate the conditions of Surolon and the potential of a rebound.

With the Solana RSI now greater than 70, the asset has officially entered the exaggerated territory, reflecting intense short -term purchase pressure.

Although this can sometimes precede a correction or consolidation, it can also point out the start of a broken rally.

Merchants must closely monitor the signs of continuation or exhaustion. If the momentum holds, Solana could push higher, but any Stalling can trigger profits and short -term volatility.

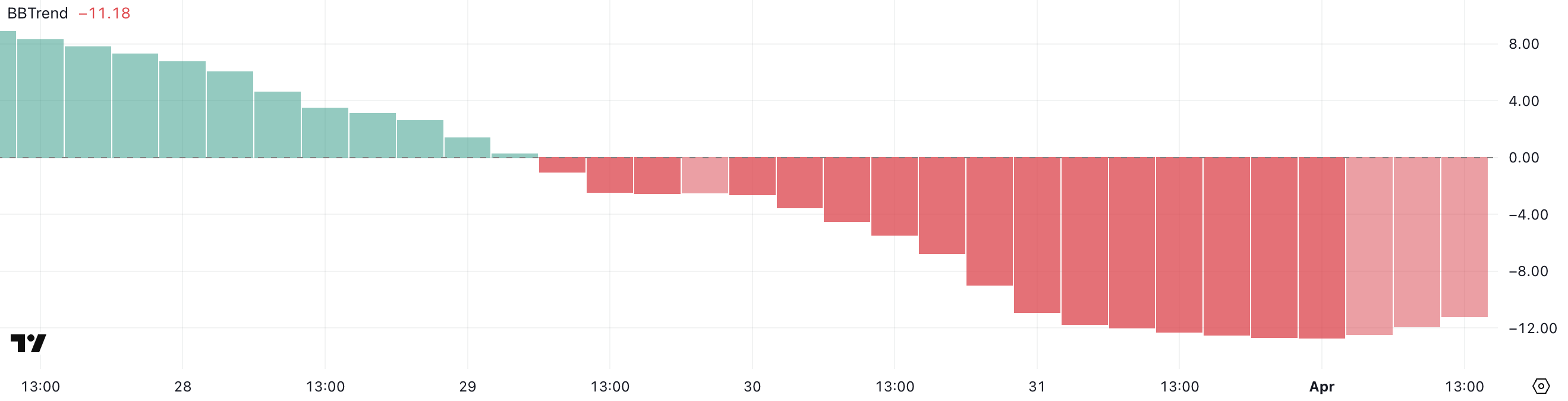

Solana Bbtrend decreases, but still very negative

The Bbtrend indicator of Solana climbed slightly at -11,18 after reaching a hollow of -12.68 earlier in the day. This suggests that the lowering momentum is starting to relax.

The Bbtrend (Bollinger Band Trend) measures the strength and the direction of a trend according to the way the price interacts with the Bollinger bands.

The values lower than -10 generally indicate a strong downward pressure, while the values above +10 reflect a strong bullish momentum. A BBTREND from deep negative territory can be an early sign of a potential reversal or at least a slowdown in the downward trend.

With soil bbtrend still in lower but improving territory, the market can try to stabilize after an intense sales period.

However, broader ecosystems developments complicate the technical image. For example, Ethereum recently exceeded Solana in DEX volume for the first time in six months.

While Bbtrend relaxation refers to the recovery potential, Solana still needs a stronger confirmation to fully move the trend in its favor. Until then, cautious optimism can be justified, but the bears have not completely dropped.

Solana still has future challenges

Solana’s EMA lines show signs of an imminent golden cross. A golden cross occurs when a short -term mobile average crosses a long -term average. It is often considered a bullish signal that can mark the start of a sustained increase trend.

If this model is confirmed and the purchase continues, Solana Price could push to test the resistance at $ 131.

A successful escape above this level can open the door to additional gains around $ 136, and potentially even $ 147.

However, downward risks remain if buyers do not hold recent gains.

If soil decreases and loses the key support at $ 124, it could trigger additional sales pressure, pushing the price at $ 120.

If the downward trend is gaining strength from there, Sol could review the deeper support levels around $ 112.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.