TRX Demand Indicators Show Where Tron Price is Headed

Tron (TRX) experienced a sharp increase in prices, reaching a 5 -month summit. However, the recent bullish impulse seems to lose steam, signaling the potential of a price correction.

Although the asset has worked well, there are signs that TRX could be overvalued in the short term, which can cause withdrawal.

Tron is overvalued

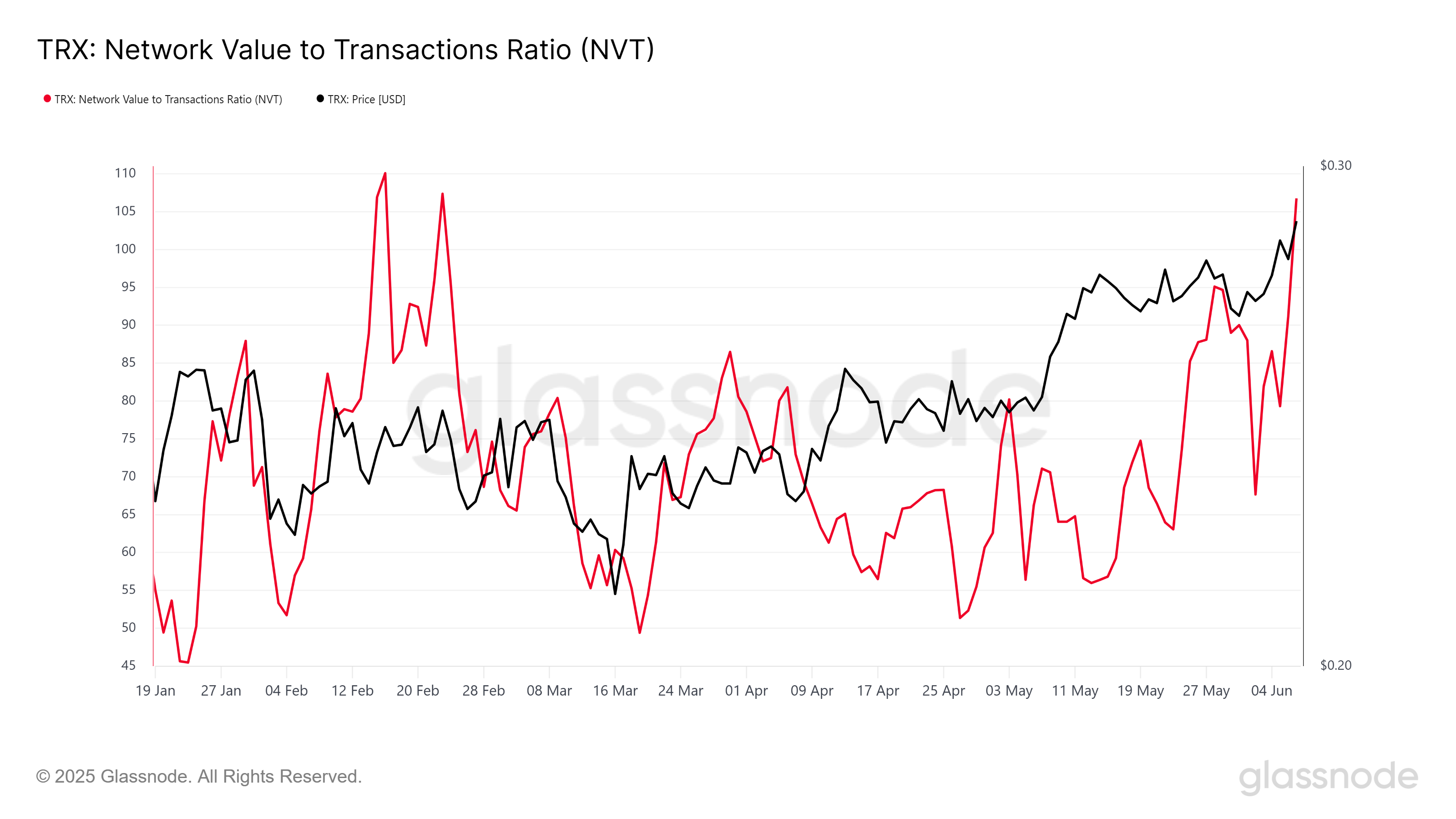

The ratio of the value of the network / transactions (NVT) for Tron has increased, reaching its highest level in a month and a half. NVT measures the relationship between the market value of a network and its transaction volume.

A growing NVT often points out that the market value of an asset exceeds its transactional activity, which suggests an over -making. In the case of TRX, this increase in TNV is a potential red flag.

With the increase in the NVT ratio, TRX could face the downward pressure while investors adjust their expectations. The overvaluation of the token could lead to a sale, especially if the feeling of the market moves towards caution.

Consequently, a price correction seems likely, especially if the wider market of cryptocurrency experiences a cooling period.

Despite the concerns about the overvaluation, the global macro dynamics of TRX may not lead to a strong correction. The Iomap Indotheblock indicator shows a solid demand zone between $ 0.268 and $ 0.276, where approximately 13.89 billion TRX worth almost $ 4 billion was purchased.

This substantial accumulation area provides a stamp for TRX, because investors who buy at these levels are unlikely to sell without profit.

The request zone is crucial because it represents a price price that could prevent TRX from falling too far. As the market has shown interest in this price range, the chances of falling from TRX below $ 0.276 in the short term are reduced.

If TRX undergoes a correction, it should find solid support in this area, keeping the price higher at the critical level of $ 0.276.

Will TRX Price be a dive?

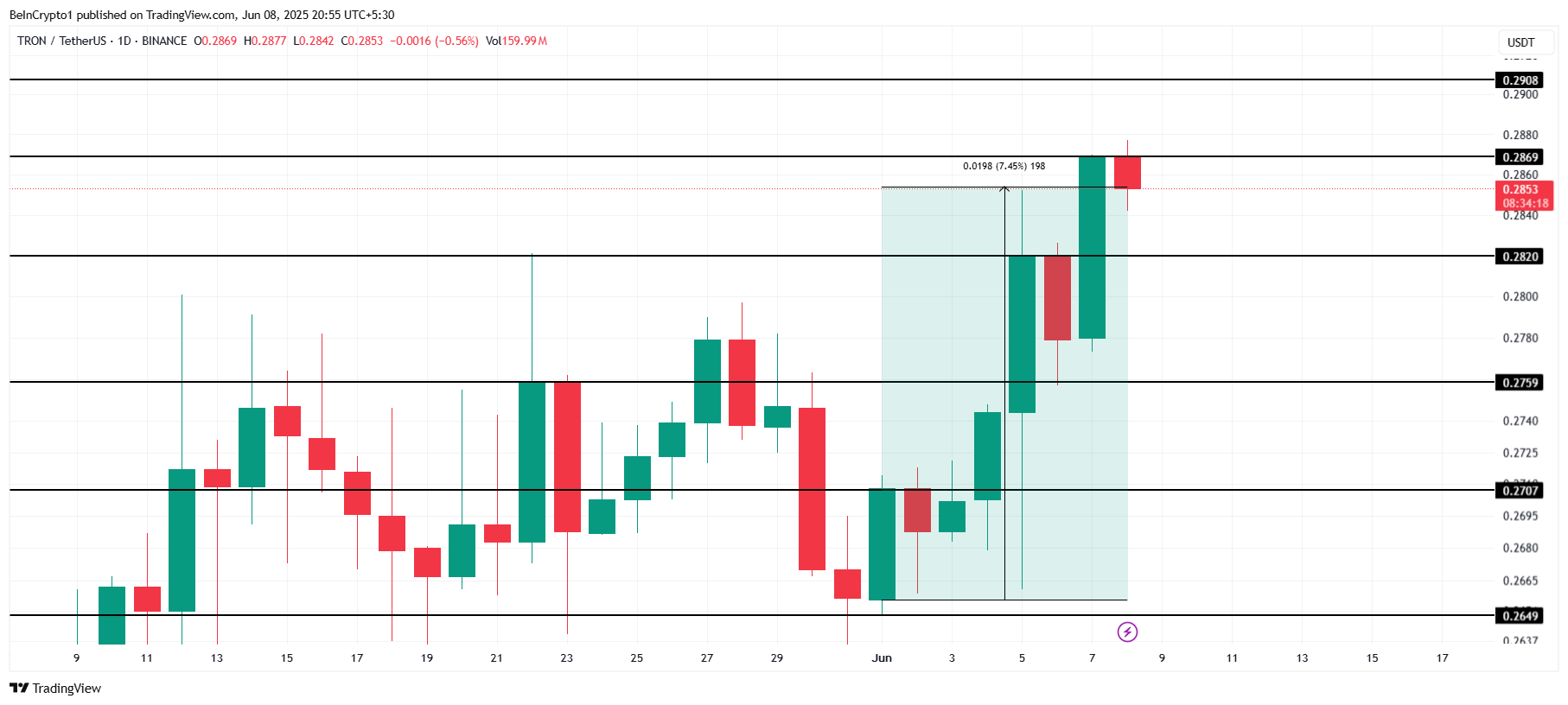

TRX won 7.45% in last week, trading at $ 0.285 at the time of the editorial staff. It is currently faced with resistance at $ 0.286, which has proven to be a difficult level to break. Given the recent increase in price, the token approaches a critical point.

If TRX fails to violate the resistance of 0.286, it could face a decline, investors make the profits.

If the overvalued state triggers a drop in prices, TRX could drop below $ 0.282 and go to the support level of $ 0.275. A fall below this level is unlikely due to the high demand zone of approximately 0.268 to 0.276 $, which should provide price support. The correction should be moderate, the request zone preventing a more serious decline.

On the other hand, if the wider market remains optimistic, TRX can exceed the resistance level of $ 0.286. A successful violation of this barrier could see TRX evolve around $ 0.290. This would invalidate the lowering prospects and prepared the field for an additional price appreciation.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.